April seasonals were absolutely brilliant.

After 10 consecutive years of cable gains in April, they said it couldn't be done again because of a tight election. They were wrong as the pound climbed 3.6% in its best monthly rally since Sept 2013.

Other April seasonals I talked about noted that it was the best month on the calendar for the euro (+4.6%, breaking a 9-month losing streak) and an excellent month for commodity currencies (they all rose). Overall, I noted that it was a dismal month for the US dollar and that turned out the be the case.

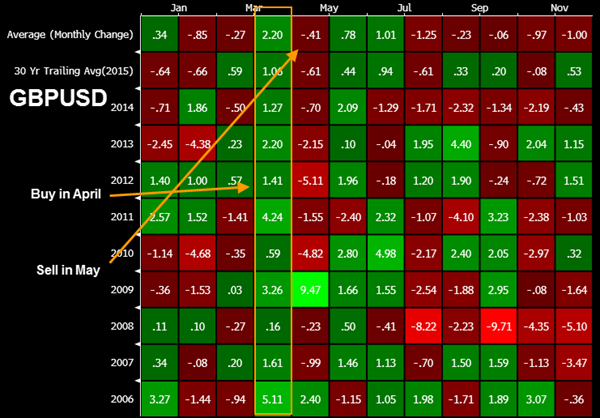

April is among the most-pristine months for seasonals but May is a good one as well.

The general theme is a reversal of what happened in April.

Here is the breakdown.

- May is the worst month for the euro with losses in 7 of the past 8 years

- May is the second-worst month for cable, nearly tied with August, over the past 30 years

- May is neutral for USD/CAD and USD/JPY

- May is the fourth worst month for cable, averaging a 0.61% decline over the past 30 years but has posted declines in 5 straight years

- 'Sell in May' for stocks is over. The S&P 500 averaged a 1.35% gain in May over the past 30 years

I wrote about gold seasonals and explained other reasons why may will bring misery for gold bulls. I also wrote about the three best spots to buy the US dollar