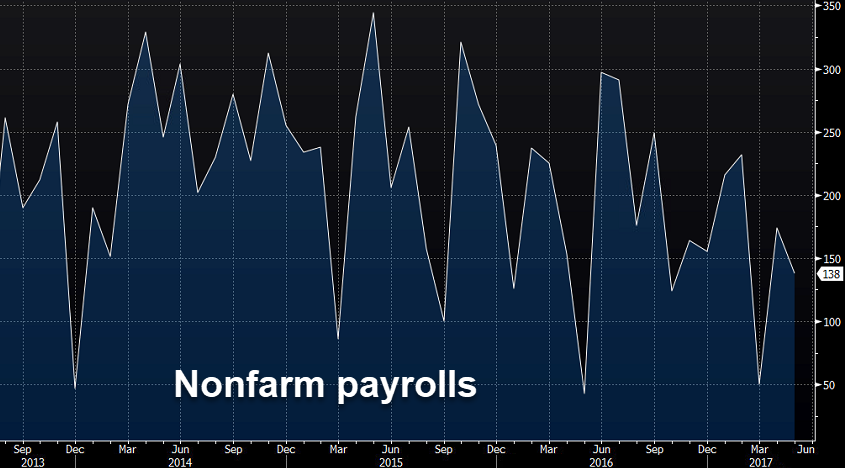

Highlights of the May 2017 nonfarm payrolls report released June 2, 2017

- Prior was 211K (revised to 174K)

- March revised to +50K from +74K

- Private payrolls 147K vs 175K expected

- Unemployment rate 4.3% vs 4.4% exp

- Prior unemployment 4.4% (4.7% two months ago)

- Participation rate 62.7% vs 62.9% prior

- U6 underemployment 8.4% vs 8.6% prior

- Average hourly earnings +0.2% vs +0.2% exp m/m

- Prior average hourly earnings 0.3% y/y (revised to +0.2%)

- Avg hourly earnings 2.5% vs 2.6% exp y/y

- Prior average hourly earnings 2.5% y/y

- Average weekly hours 34.4 vs 34.4 exp

- Prior avg hourly earnings 34.4

There was some chatter about a low wage number before the data because there were a high number of working days in May and most workers are paid a salary. You would think that would be stripped out in the BLS's seasonal adjustments but it's an idea that was out there.

The US dollar dropped on the headlines across the board. USD/JPY fell nearly 50 pips to 111.00 while EUR/USD rose about 40 pips.

The only really good news in the report is the fall in the unemployment and underemployment rate but that's entirely mitigated by the fall in participation.

Overall, it's a mildly disappointing report and the scale of US dollar selling shows how the market is positioned.