Traders are still willing to hit the euro bounces

Leveraged seller are the latest to try and take advantage of the jump in the euro. Constantly hitting these jumps is proving profitable, and it is a good trade against the backdrop of ECB easing

At the moment that battle is finely balanced. Rallies are being snuffed out as soon as the dust settles and there's still not really a fundamental reason to buy the euro, from the euro side

Stocks have stabilised above the lows, though US futures point to early losses in the US. Watch out for the catch up effect early in US trading

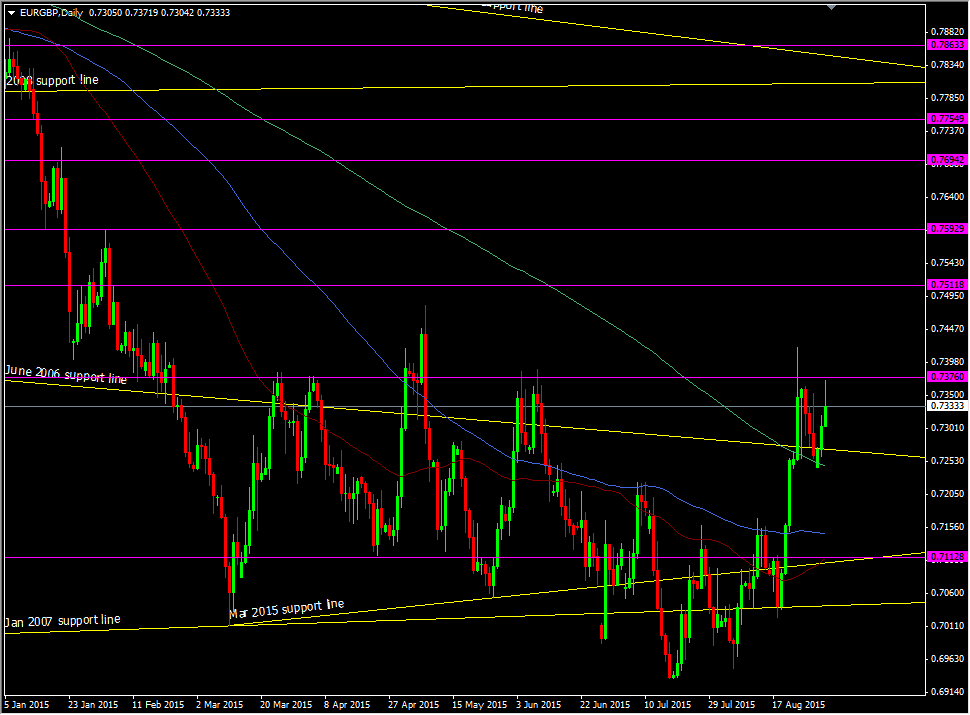

EURGBP has hit the topside boundary once again and most of that came through the poor UK PMI

EURGBP daily chart

It's proving a good level up here to nick a few pips from

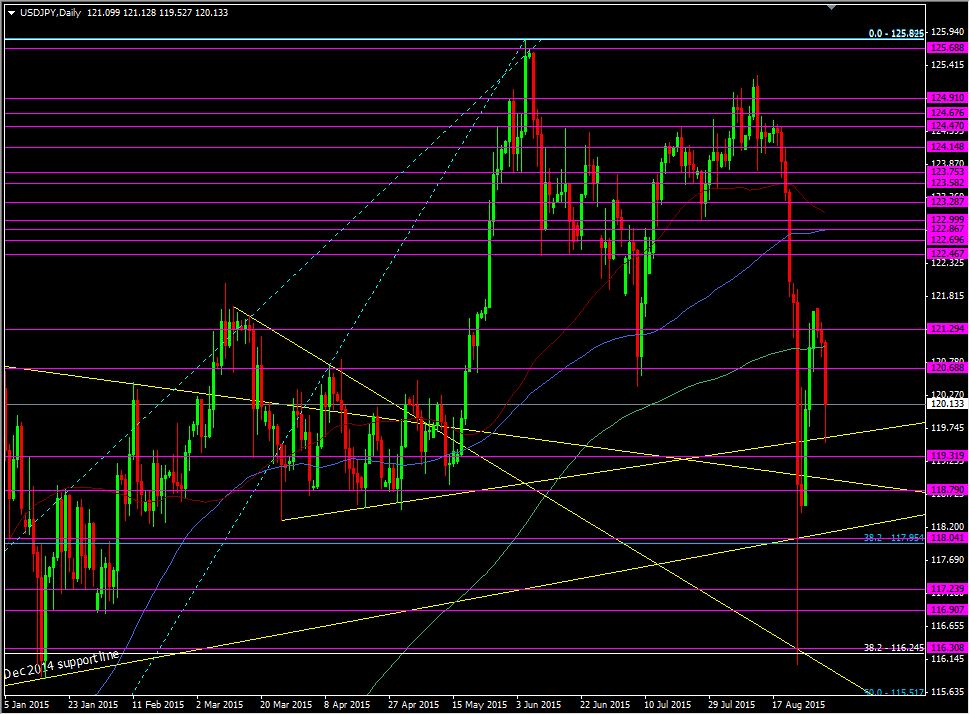

USDJPY managed to bounce from old support that failed in last weeks washout, just ahead of 119.50 and has broken back into 120.00 as I type. 120.70 becomes resistance once more should we climb that high

USDJPY daily chart

I get the feeling that the market has maybe just exhausted itself for now and that players are now sitting in wait for the next spark to appear to get us going again

That can be difficult for traders to read so stick to the strong tech levels that have developed and try not to mess around in the middle