From Credit Suisse:

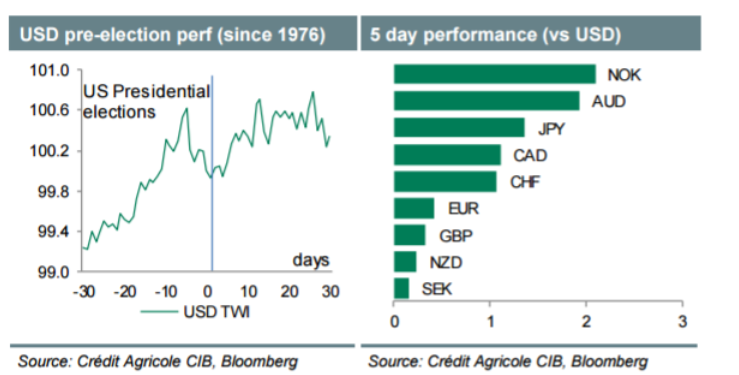

This past week the BoJ extended the life of its fading QE programme 'on the cheap' while the Fed remained cautious, assessing the need for further tightening. The markets took this as a risk-on/ USD-off outcome. The USD-off lean could persist for now as we approach the first televised presidential debate in the US next week. Indeed, we believe that the markets are rather complacent about the outcome of the elections and expect growing uncertainty ahead of the 8 November vote to add to the USD-headwinds. The US data calendar is fairly light but we have a flurry of Fed speeches. It would take positive data surprises and consistently hawkish comments next week to see the near-term outlook for USD change, however.

EUR and JPY should remain supported against USD. Indeed, if both the ECB and the BoJ are running out of options to ease aggressively from here, the Fed may be forced to incorporate global developments even more in its decision making process. To the extent that this translates in an even more cautious Fed, we suspect that USD will struggle to perform against the hitherto two main funding currencies. We suspect that data releases out of Japan and the Eurozone next week will support the view that there is no pressing need for the BoJ or the ECB to reconsider their monetary policy stance any time soon.

Where we believe that cautiousness is advised is investors' willingness to buy risk, after presumably having found comfort in the fact that the BoJ has committed to capping the 10Y JGB yields at 0% while the Fed has scaled back further its long-term rate hike expectations. To us, the recent developments are consistent with the fact that the 'central bank puts' that were propping up markets for so long are starting to expire. Coupled with another Fed hike before long (however cautious) this should lead to tightening in the global financial conditions and risk off.

While the timing of the call is inherently uncertain, we believe that the combination of FX overvaluation, stretched market longs and growing downside risks make for a challenging medium-term outlook for the commodity currencies. In the near term, potential disappointments from the informal OPEC meeting to freeze oil output as well as the Canadian GDP and the Norwegian unemployment data could trigger some profit taking in NOK and CAD. In addition, underwhelming sentiment data out of China could erode demand for NZD and AUD.

For bank trade ideas, check out eFX Plus.