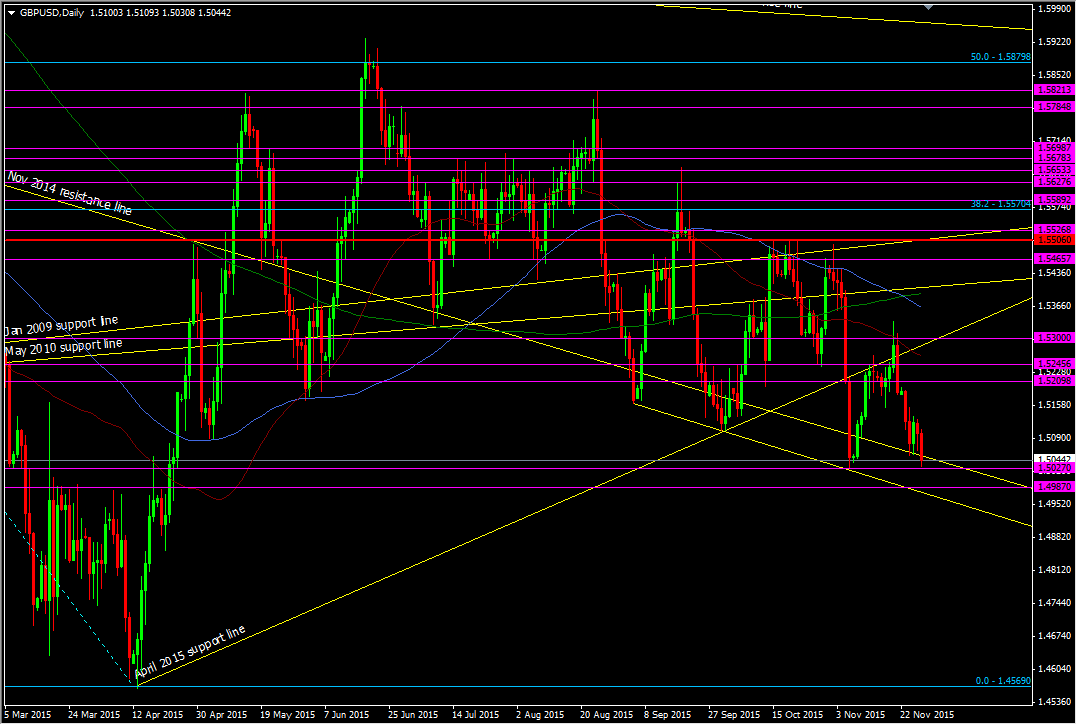

The pound could be in real trouble if it breaks the psychological 1.50 level but there's still other levels in play

GBPUSD has already pulled up near the 6 Nov low at 1.5027 with a low so far of 1.5031. It would form a decent double bottom if it does build here

Failing that we're on for a test of 1.5000. There's strong demand from 1.5010 to 1.5000 and talk that bids are also from sovereign demand. Add to that the strong barrier interest still in place and the level is becoming a sizeable one. That also means that there's likely some big stops lurking on a break and probably around the 1.4990 area

GBPUSD daily chart

That area in itself has been a former strong resistance point going back to Mar/Apr and indeed back to the start of the year. From around 1.4985/70 we can see the series of high points but no closes above the level. It shows how big 1.50 has been historically when we see so much selling around it

We also have support line from Sep that comes in at 1.4975

I may have missed the opportunity to grab a long from 1.5030 as we trade back to 1.5050. We'll now probably see that 1.5030 buying step up to around 1.5040 to protect this run

I'm going to be watching the 1.50 area very carefully with regards to my cable longs but I also fancy buying ahead of 1.50 for a shorter term play, with a stop sub 1.4970. If think if I see 1.4970 go and then a hold below, I'm going to cash in my longer term positions and see what the outcome of the Fed brings, as I can see further pain coming from them hiking