Goldman Sachs FOMC preview

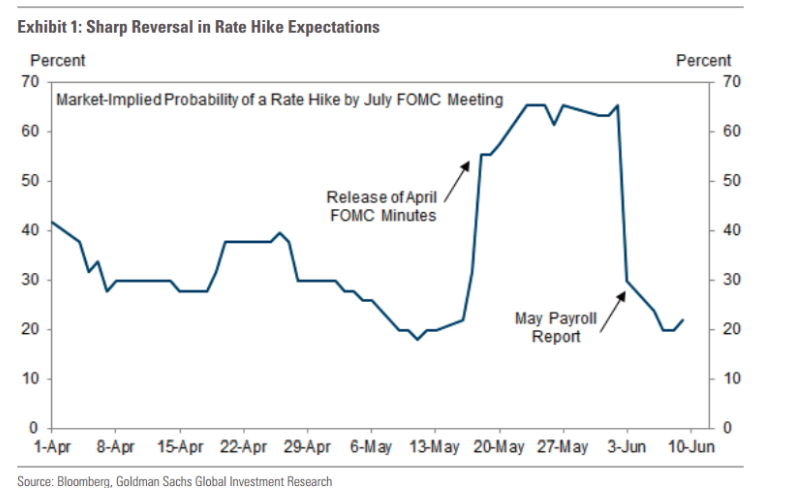

After the weak May employment report, investors have effectively ruled out a rate hike by the FOMC next week, and most see little chance of action in July as well. The key question for the policy outlook is whether the soft jobs report was an aberration, or whether it signals a meaningful deterioration in the labor market.

Payroll growth was indeed quite soft, and to an extent that cannot be explained by normal month-to-month volatility. The slowing was also party validated by weakness in other indicators, including the payroll diffusion index and the employment measure in the services ISM.

However, it is much too soon to sound the alarms. First, adjusted for the Verizon strike, payroll employment growth was not much below our estimate of its trend or "breakeven" level. Second, downward revisions to prior months reflected seasonal adjustment changes, so we would caution against extrapolating a trend. Third, other labor market indicators, such as jobless claims, have held up better. We see a slowing, not a slump, in the latest labor market data.

The natural reaction of policymakers will be to await more information while keeping options open. We expect the Fed to stand pat next week, but to keep a rate hike in the near future on the table. We expect small changes to the economic outlook, and for the median funds rate estimate in the Summary of Economic Projections (SEP) to remain unchanged for this year; the pace of rate increases beyond this year will probably come down.

After reviewing the latest labor market data and Fed communication in more detail, we are tweaking our subjective probabilities of a rate increase over the next few meetings. We now see a 35% chance of a rate hike in July (down from 40%) and a 35% chance of an increase in September (up from 30%). At this stage we are not changing our subjective odds of a rate hike by September. With the unemployment rate at 4.7%, wage growth clearly picking up, and financial conditions much easier, there is likely a limit to how long the Fed's pause can last

For bank trade ideas, check out eFX Plus.