A look at the Fed probabilities after the non-farm payrolls report

WSJ Fedwatcher writes that the soft non-farm payrolls report will give the FOMC 'serious pause' about moving rates in June.

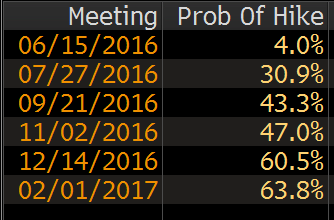

The Fed funds futures market has obliterated the chance of a June hike, knocking it down to 4% from around 30% before the report.

The market has quickly soured on July as well and it's at 30.9% compared to 54% last Friday.

A chart of the July implied probabilities shows the jump starting with the hawkish FOMC minutes and the drop since.

Janet Yellen will speak at 12:30 pm ET on Monday on the economy and will likely offer a signal on the post-NFP Fed thinking. Many now expect her to punt and for the Fed to wait for the June jobs report before swaying markets. However, she may make an effort to keep July in play.

"The employment report gives Fed officials incentive to wait until July and look at another jobs report to comfort themselves that the recent slowdown is temporary before they take their next step raising rates," Hilsenrath writes.