highlights from the January 2016 US industrial production data report 17 February 2016

- Prior -0.4%. Revised to -0.7%

- Manufacturing output 0.5% vs +0.3% exp m/m. Prior -0.1%. Revised to -0.7%

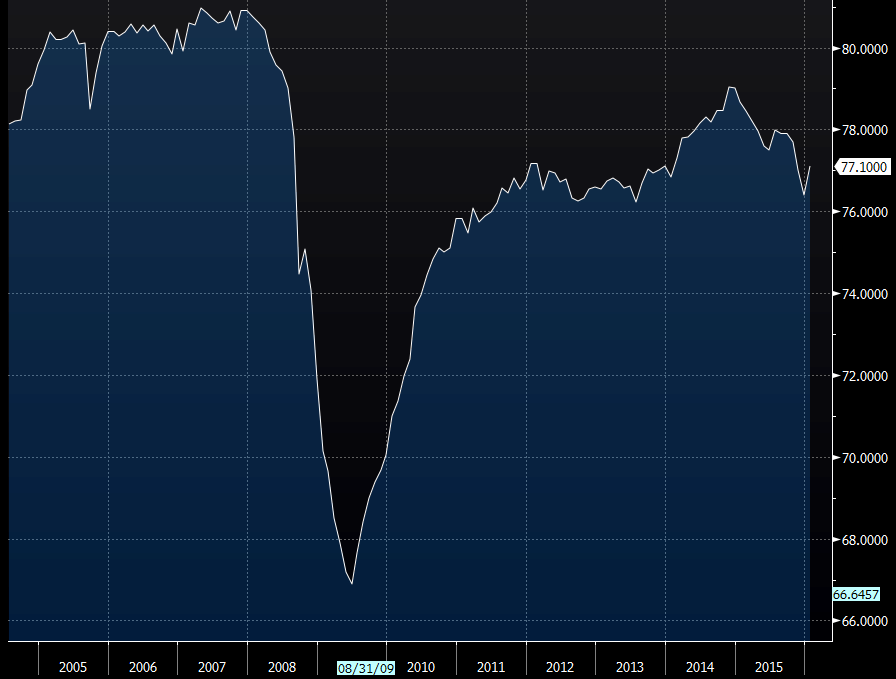

- Capacity utilisation 77.1% vs 76.7% exp. Prior 76.5%. Revised to 76.4%

A decent gain for production to kick Q1 off with. Only one component saw a loss. Vehicles and parts was probably the main driver of manufacturing output but there was a decent rise in consumer goods which suggests there's confidence that the US consumer will be spending

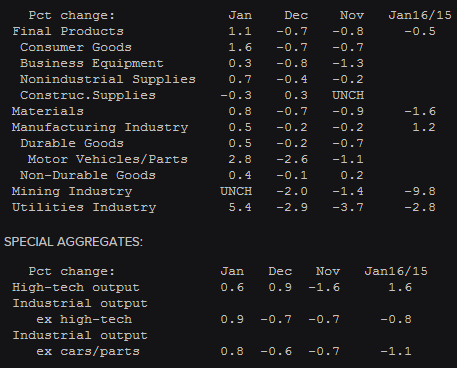

IP details

The jump in the utilities will also be a driving force behind the rising headline number.

The higher capacity might put a halt on a slide that's run from the latter part of 2014. If sustained, it would be another good sign for both industrial and manufacturing sectors, and potentially a great signal for jobs and investment. Let's not run before we can walk though ;-)

Capacity utilisation

Once again it's been EURUSD that's seen the action, and cable has joined in too. EURUSD dropped to 1.1106 from 1.1120 and GBPUSD dropped to 1.4245 from 1.4280