Morgan Stanley gets a great fill in USDJPY

Last week Morgan Stanley placed a buy limit at 112.50 in USDJPY. Seeing as the low, according to Bloomberg, on the 17th was 112.57, and 112.55 on Reuters, I'm surprised to read their latest weekly note saying that the order was filled, and now they're well in profit.

Before we all go jumping up and down, maybe they just weren't 'dicks for a tick' and went to market on their order at the low instead, and just forgot to report the real fill level. Maybe it's a typo, who knows? I just wish I got fills like that on my trades ;-)

Alongside that new trade, they've also dipped into USDCAD longs with a buy at last night's NY close, and are looking for 1.3800 with a stop at 1.3100.

"We have turned bearish CAD and are buying USDCAD as

yesterday's BoC meeting was a game-changer for the near-term

outlook. A moderately dovish statement was followed up by an

even more dovish press conference in which the BoC argued a

rate cut is still on the table and that despite the market's pricing

in of 12bps of hikes this year, the BoC still expects the output gap

to only close in mid-2018 (unchanged from last time). They also

argued Canada wouldn't benefit much from Trump's proposed

fiscal policies and faces risks from a rise in protectionism. Despite

this rhetoric, the market is still pricing in 10bps of hikes. As this

pricing adjusts lower towards a more flat curve, and USD rallies broadly, we expect

USDCAD to perform well. The risk to this trade is better Canadian data or a hawkish

turn by the BoC away from its recent rhetoric."

They also like a GBPJPY long and bought that too on the NY close, with a 148.00 TP and 139.30 stop.

"Theresa May's 12 point Brexit plan suggests the U.K is aiming for a

clean exit from the EU. However, unlike impressions left after her

previous speeches (where she was too inward looking) she

offered an open Brexit. Suggesting the Parliament will vote on the

Brexit negotiation result while leaving no doubt her government

is prepared to walk away from negotiations should these turn out

to become unattractive, has offered both a carrot and stick. GBP's

reaction to May's speech revealed a short positioned market that

had room for further adjust. GBPUSD may move back to 1.27/28

but we prefer trading long GBPJPY.We think the key takeaway

from Theresa May was either the UK will have access to the single market or we change

our business model. We would also put particular focus on May's comments which

could lead to the UK potentially getting continued access to the single market, without a

'cliff edge'. We think the JPY should weaken as the BoJ remains accomodative and global

inflation expectations rise. The risk to our view is a rapid lowering of US yields."

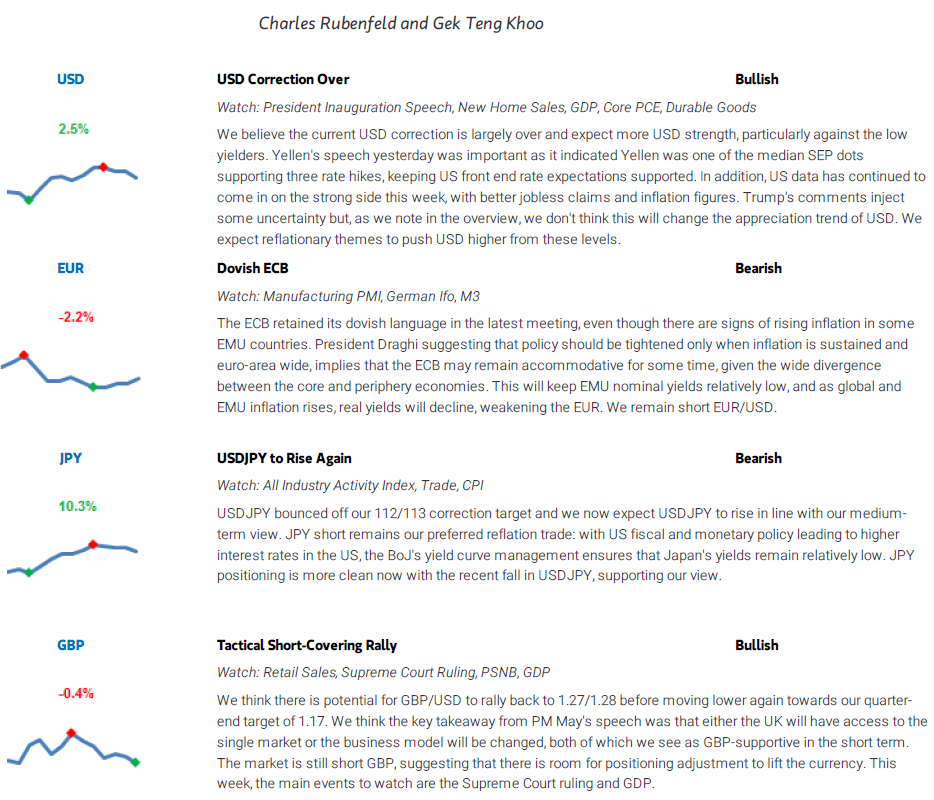

Here's their brief for four majors.