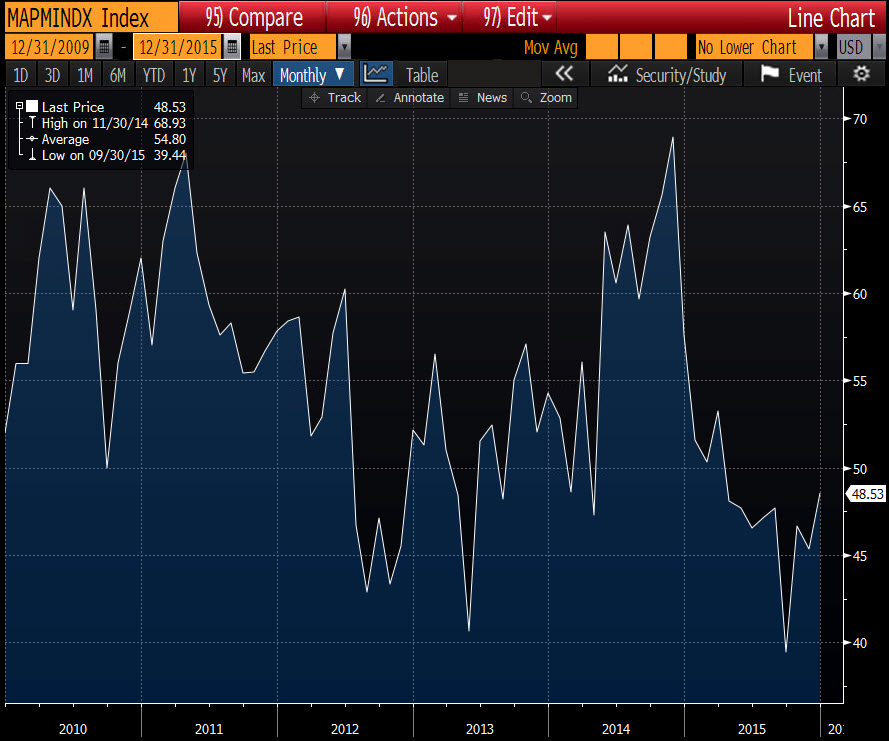

Up from last month 45.3

- New orders 50.25 vs 39.6 last month

- Production 50.25 vs 47.14

- Employment 51.76 vs 48.16

- Supplier deliveries 43.96 vs 48.92

- Inventories 46.43 vs 42.86

- Prices 25.00 vs 21.43

- Backlog of orders 32.14 vs 39.29

- Exports 45.00 vs 50.00

- Imports 50 vs 50.00

A reading below 50 still represents more businesses who said business is deteriorating

The Chicago PMI will be released at 9:45 AM ET with estimates at 50.0 vs 48.7 in November.

For your guide the NYSE and other exchanges remain open until 4 PM. The US bond market recommends a 2 PM ET closing. Of course stock and bond markets will be closed tomorrow on January 1.

Speaking of US bonds:

2 year is at 1.06% down 2 bp

5 year is 1.77% down 2 bp

10 year is 2.27% down 2 bp

30 year is 3.02% down 1 bp

In Europe:

German 10 year 0.63% unchanged

France 10 year 0.99% unchanged

Italy 10 year, 1.59% -4 bp

Spain 10 year, 1.77% -4 bp

UK 10 year, 1.96%, -3 bp

The big question for the day might be does the S&P end the year up or down on the year.

As of now:

S&P +0.22% for the year

Nasdaq is up 6.96%

Dow is down -1.23%