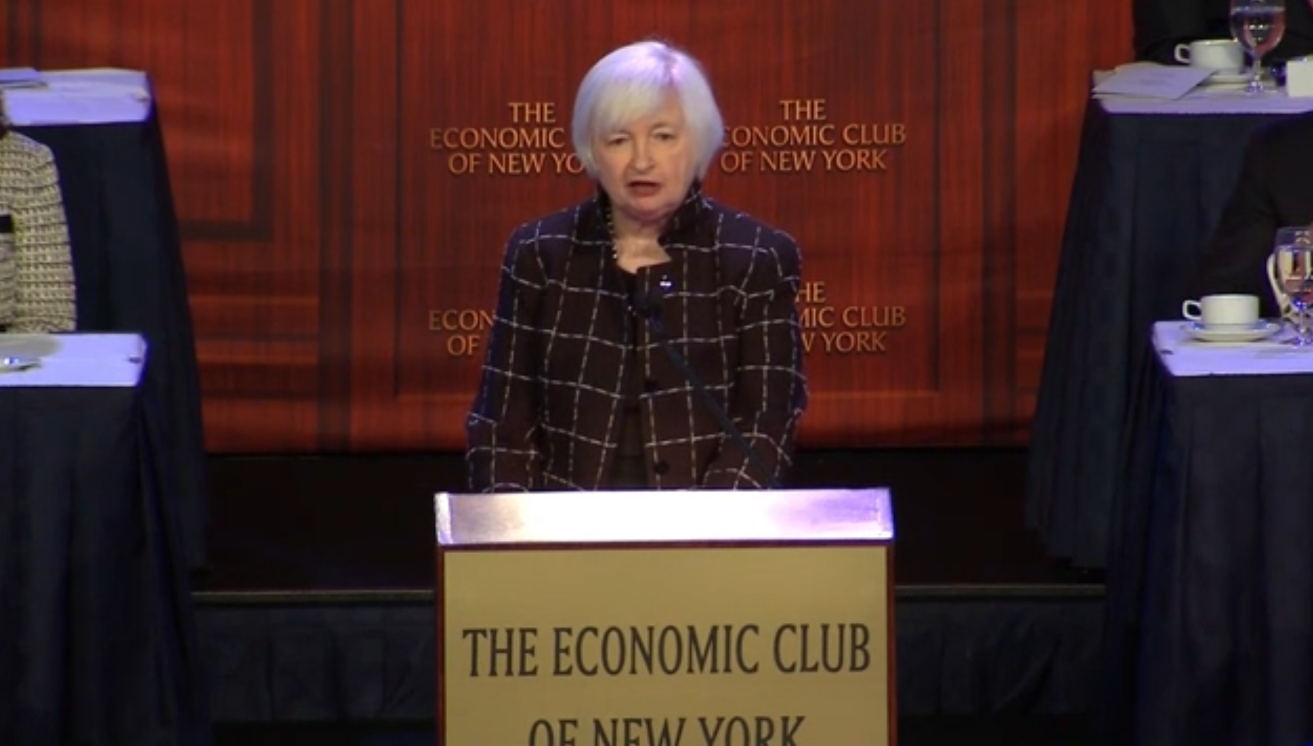

Yellen on the economy and the outlook

1) "Given the risks to the outlook, I consider it appropriate for the Committee to proceed cautiously in adjusting policy. This caution is especially warranted because, with the federal funds rate so low, the FOMC's ability to use conventional monetary policy to respond to economic disturbances is asymmetric"

2) "Only gradual increases in the federal funds rate are likely to be warranted in coming years."

3) "Even if the federal funds rate were to return to near zero, the FOMC would still have considerable scope to provide additional accommodation."

4) "The decline in market expectations since December for the future path of the federal funds rate and accompanying downward pressure on long-term interest rates have helped to offset the contractionary effects of somewhat less favorable financial conditions and slower foreign growth. In addition, the public's expectation that the Fed will respond to economic disturbances in a predictable manner to reduce or offset their potential harmful effects means that the public is apt to react less adversely to such shocks--a response which serves to stabilize the expectations underpinning hiring and spending decisions."

5) "Lately, however, there have been signs that inflation expectations may have drifted down... my baseline assumption of stable expectations is still justified. Nevertheless, the decline in some indicators has heightened the risk that this judgment could be wrong."

The final one sums up what to watch in the months ahead:

6) "On balance, overall employment has continued to grow at a solid pace so far this year, in part because domestic household spending has been sufficiently strong to offset the drag coming from abroad. Looking forward however, we have to take into account the potential fallout from recent global economic and financial developments, which have been marked by bouts of turbulence since the turn of the year. For a time, equity prices were down sharply, oil traded at less than $30 per barrel, and many currencies were depreciating against the dollar. Although prices in these markets have since largely returned to where they stood at the start of the year, in other respects economic and financial conditions remain less favorable than they did back at the time of the December FOMC meeting. In particular, foreign economic growth now seems likely to be weaker this year than previously expected, and earnings expectations have declined. By themselves, these developments would tend to restrain U.S. economic activity. But those effects have been at least partially offset by downward revisions to market expectations for the federal funds rate that in turn have put downward pressure on longer-term interest rates, including mortgage rates, thereby helping to support spending. For these reasons, I anticipate that the overall fallout for the U.S. economy from global market developments since the start of the year will most likely be limited, although this assessment is subject to considerable uncertainty."

Here is the full text of the speech.