There's nothing like sitting down at your desk first thing and seeing blood on the screens.

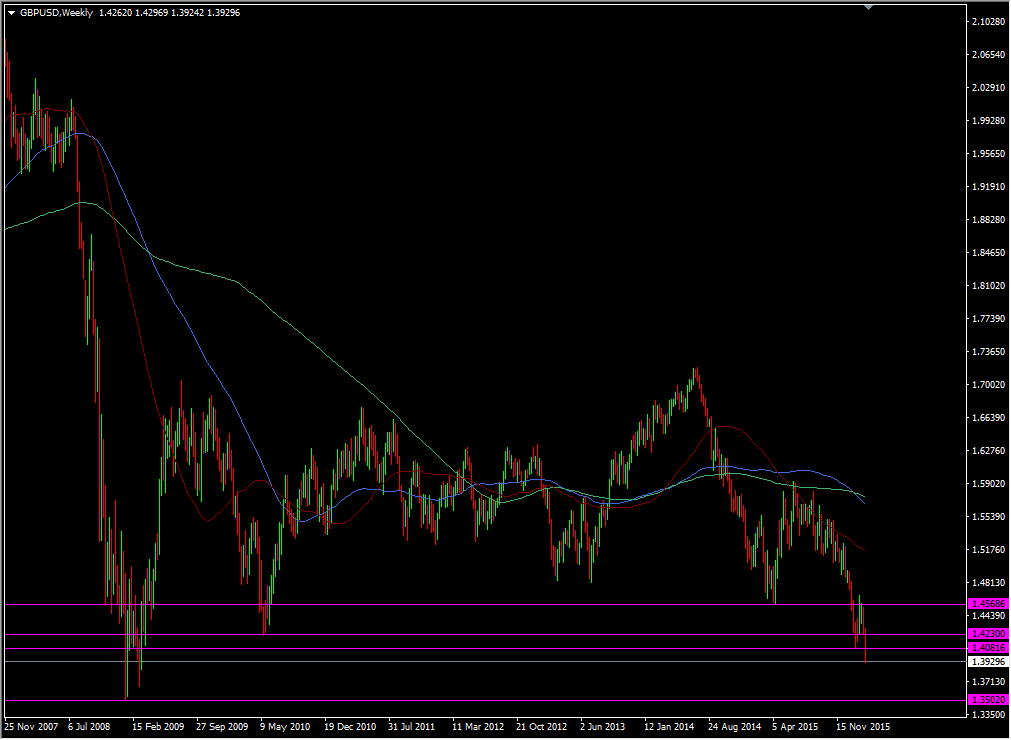

GBPUSD managed to hold above 1.40 last in the European day and into Asia before giving way meekly. I suspected any break would bring additional damage and here we are nearly 80 pips south of there already. The big damage might be done hear and there's every chance of seeing a fall to the 1.35's with minor stoppages on the way.

GBPUSD weekly chart

The euro has also finally made a proper break below 1.1000 but it's only grabbed an extra 10-15 pips under the 1.0990 support. If 1.0990 holds now we are likely to push down again.

The trading desks are putting both cable and the euro in the same Brexit basket. London traders note that all sorts of players are selling both the pound and euro. I mentioned Monday that the euro will also be a victim of UK exit talk and we're seeing that play out. With European stocks falling down a hole also, you can scratch the euro funding currency correlation for now.

The moves are broad with the yen in the thick of it too as usual. AUDUSD has turned south, oil has turned south. Looks like the mood is very dour today.

Sometimes when the market sentiment is bad there's not a lot that can change it. In those circumstances trying to pick tops and bottoms becomes a far more dangerous game.

A real life cable chart