From HSBC's 'Currency Outlook' research note for February

The main article is about you-know-who ... but enough about him, I'm taking a look at their section on the AUD. It's a long piece, but in brief, bolding mine:

The AUD has generally had three distinct and clear drivers:

- commodity prices,

- China

- and carry.

When these three drivers aligned, one-way traffic provides a clear path for the AUD. We saw this clearly in both the bull market and the bear market. When the three Cs aligned in the bull market of 2009-2011, AUD-USD rallied from 0.65 to 1.10. The AUD then drifted sideways until the three Cs aligned in the bear market of 2013-2016, AUD-USD fell from 1.05 to 0.70.

The issue now is that these three factors are not aligned. On top of this, the relationship between the AUD and its drivers has changed.

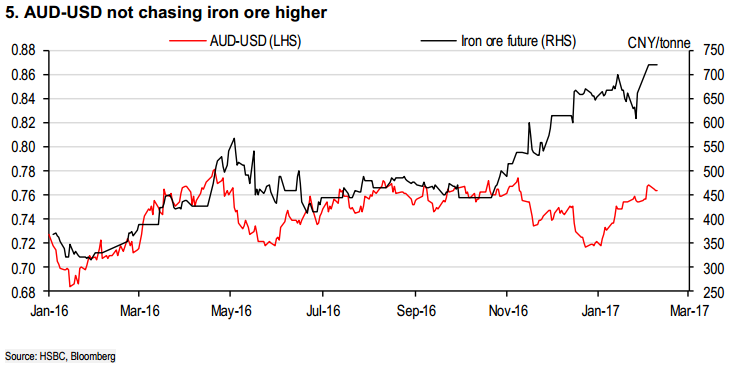

1) The AUD has failed to keep up with stronger commodity prices.

2) China's economic stability does not point us in a clear direction for the AUD, and risks of a US-China trade spat would leave the AUD exposed.

3) This leaves interest rate differentials as the dominant driver of AUD-USD.

The problem here is to get AUD-USD correct, both US rates and Australian rates must be forecast correctly. For now we think as the Fed tightens policy, Australia's carry buffer will erode putting AUD-USD under downward pressure. For this reason we expect AUD to weaken from here.

Carry is now driving the AUD but we are keeping one eye on the other two key factors. For a clear trend in the AUD the three factors must align. Alternatively, completely new drivers may emerge. The AUD is going walkabout until it discovers new, or rediscovers its old, drivers.