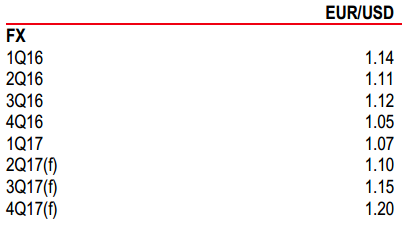

Via HSBC Global Research, forecasts for the euro and yen

HSBC cite (in very brief):

- The results from the first round of the French presidential election should be EUR-positive

- Meanwhile, in the US, the government has struggled repeatedly to meet the market's high expectations

- With both these factors in mind, HSBC recently revised year-end forecasts for EUR-USD and USD-JPY to 1.20 and 100, respectively

And, a few more points from HSBC (bolding mine):

- A stronger EUR and a stronger JPY also have important implications for the more trade dependent currencies, such as the CNY, the KRW and the TWD

- As such, we revised these forecasts, and we are now expecting USD-CNY to end 2017 at 7.10 (from 7.20)

- However, for now, our broader view for USD-EM remains unchanged

- Doubts about the sustainability of the reflation trade are emerging and this could slow the pace of portfolio inflows, which have been a key pillar of support for EM FX so far this year

- In Asia, we believe concerns that China is taking a U-turn in RMB internationalisation are overblown. China remains committed to opening up its economy and financial markets, and the Belt and Road Initiative will help promote the RMB as a financing currency. Meanwhile, the highly anticipated US Treasury report was released without naming any country as a currency manipulator. However, the report was more strongly worded and emphasised that countries should demonstrate a shift in limiting USD buying activity. Indeed, it appears some Asian countries, particularly Korea and Taiwan, have already begun to modify their FX policies.

- Finally, the MAS left its policy unchanged, and we believe local factors may take a backseat for the SGD for now