One part of the OPEC production deal isn't going according to plan

The main reason for the OPEC deal was to freeze production so that demand eats into the glut of supplies. That's all well and good until the glaring floor in the plan comes home to roost, i.e demand doesn't grow or worse, it drops.

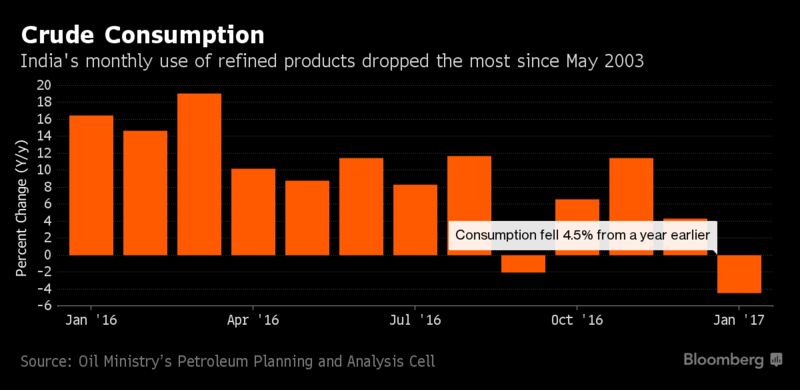

So when one of the fastest growing countries sees oil demand fall the most in 13 years, there should be alarm bells ringing at OPEC.

Bloomberg has noted the drop which has seen India's use of diesel drop 7.8% in Jan. Diesel accounts for around 40% of total fuel use. India also imports around 80% of it's oil and the IEA said it will be the fastest user of oil through to 2040.

The drop is being tied in with the recent policy crackdown on high value bank notes, which is expected to shrink economic growth. One analyst expects that this is a one off and demand will pick back up in Feb. We'll see whether he's right no doubt. If he's not then this could be a bigger issue for OPEC who will start to think about what to do with the current deal in a couple of months or so.

Russia has already said that they will discuss extending the deal in April or May.

For me, the demand part of the OPEC puzzle was always the weak link and if demand doesn't match expectations in relation to this deal, there's going to be strong calls to expend it.

The full Bloomberg story is here. H/t reader Tim for highlighting it.