As EURUSD recovers from the initial shock here is how we should approach trading over the next few days

Mike started the ball rolling this morning on what to watch for from the euro, and taking a cautious approach. The dust is settling and the market is working out what it all means

We saw last week what happens when the headlines become too much for the market and it hits the sell button first and asks questions later. Naturally we've seen that as markets opened for the new week

The fall in the euro has been around 200 pips since Friday's close and already we've undone a lot of that.

Why?

For the last two weeks at least, we've seen the market reduce risk into the weekends. We saw that again on Friday and that is one of the reasons why we didn't get a bigger gap lower and why we're seeing this bounce. Most of the market was well prepared for bad news and so it's reduced the volatility and given them better levels to re-establish positions

How do we trade it now?

Caution is still very much advised. As we know, the near technical levels stand for nothing when there's big news and so there's been plenty that have been carved through without a second thought. As we start to calm down these levels will start to re-establish themselves, and we're already seeing that happen

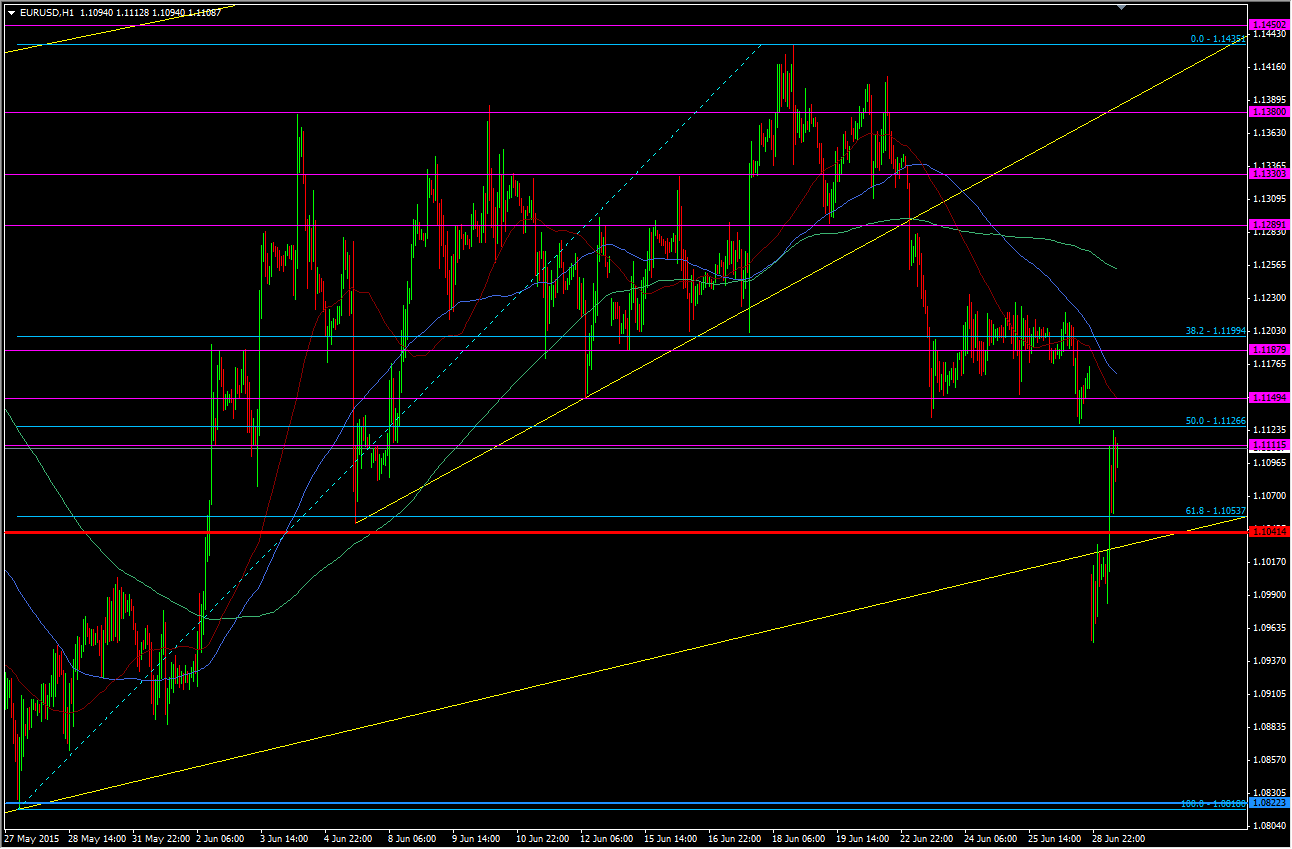

EURUSD H1 chart

The 50.0 fib of the May swing up was support last week and it's become a resistance point on the way back up. 1.1110/15 was a level I hard marked for support and the break has also seen then become resistance. The 61.8 fib was ignored on the way down and back up but it too is now playing a part as support

Even with the tech starting to have a say I would still advise keeping trades on a very tight leash. The bulk of headlines so far are from countries and governments trying to calm the situation and we're starting to get some context about what it all means. There's still a big risk from errant headlines

What does it all mean?

Briefly;

- Greece hasn't left the Eurozone

- It may default on its obligations to the IMF, who themselves won't class it as a default just yet

- The referendum may well see the Greek people voting to stay in the EZ and accepting the deal on the table

- The ECB can still support Greek banks if they so choose

- The ECB will be on standby to bring financial stability under control should things get out of hand

The wider view is that we're not looking at a Greek exit right now but the market is busy calculating what it would mean if it does happen. Most participants would have already done that homework weeks ago. Throughout the crisis central banks and governments have been putting measures in place for this very scenario and that will act as a safety net for markets, meaning we shouldn't see things get too messy

As is the case with these types of events we always get a reaction, a counter reaction and then the "now what" phase. That's where we're heading now. Stick to the longer timeframes and stronger levels on your charts as it can still be whippy on the lower timeframes. Some moves may not make sense. Read between the lines of those peddling fear and the euro going to zero and those who say it will be jelly and ice cream if Greece goes. It's going to be a mess for at least a week, and probably further so stay safe out there