ABN-AMRO doesn't think the BOJ is at the limit but the scope for something special is gone

From ABN-AMRO:

We do not think that the Bank of Japan (BoJ) has reached its limits, but there is limited room left for aggressive easing.

We expect the Bank of Japan to increase its asset purchase programme by 5-10 trillion yen per year and to extend the range of assets at the Monetary Policy Meeting on 21 September.

We expect the BoJ to cut the policy rates by 10bp to -0.2%. To reduce the impact for banks, the interest rate on funding through the Loan Support Program will likely be lowered to -0.2

An appropriate policy mix, including reforms in the labour market and a fiscal plan, would increase monetary policy effectiveness.

Implications for USD/JPY:

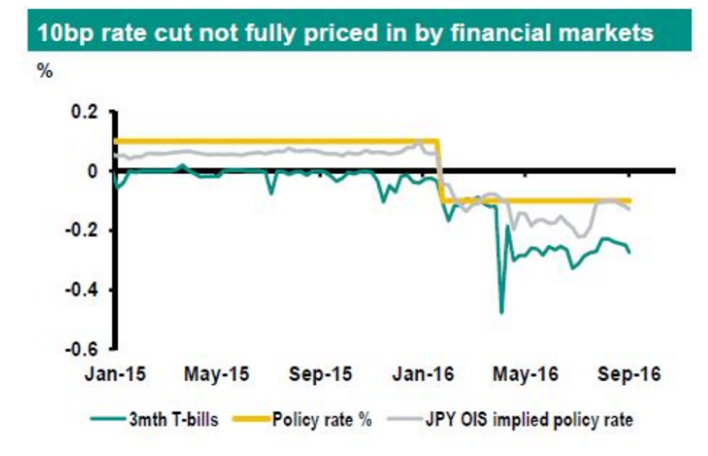

As our view that the BoJ is likely to lower the policy rate by 10bp is not fully priced in by financial markets, we expect the yen to decline as overcrowded speculative long yen positions are unwound.

However we expect domestic investors and exporters to increase their foreign currency hedging activities if the yen were to weaken above 105 against the USD. This is expected to support the yen. Nevertheless the peak in the yen against the USD of around 100 earlier this year is probably over. This is based on our view that the Fed is likely to raise interest rates by 25bp in December. This is not fully priced in by financial markets. Hence a firmer USD is expected. Our year end USD/JPY forecast is 103.

For bank trade ideas, check out eFX Plus.