Goldman Sachs on what is vulnerable to a surprise from Yellen

A surprise in Friday's speech from Janet Yellen would hit hardest in the pound, yen and kiwi, according to Goldman Sachs.

Moves in those three currencies have been most-closely correlated to changes in two-year interest rate differentials.

"While the direction of recent Fed commentary has no doubt been dovish, it is also fair to say that Fed communications have been erratic this year," Goldman Sachs wrote in their note to clients. "The pound, the yen and the New Zealand dollar should react most in the event of a surprise on Friday."

They note that 10 basis point a move in the two-year differential in favour of the US dollar equates with a 1.5% dip in cable.

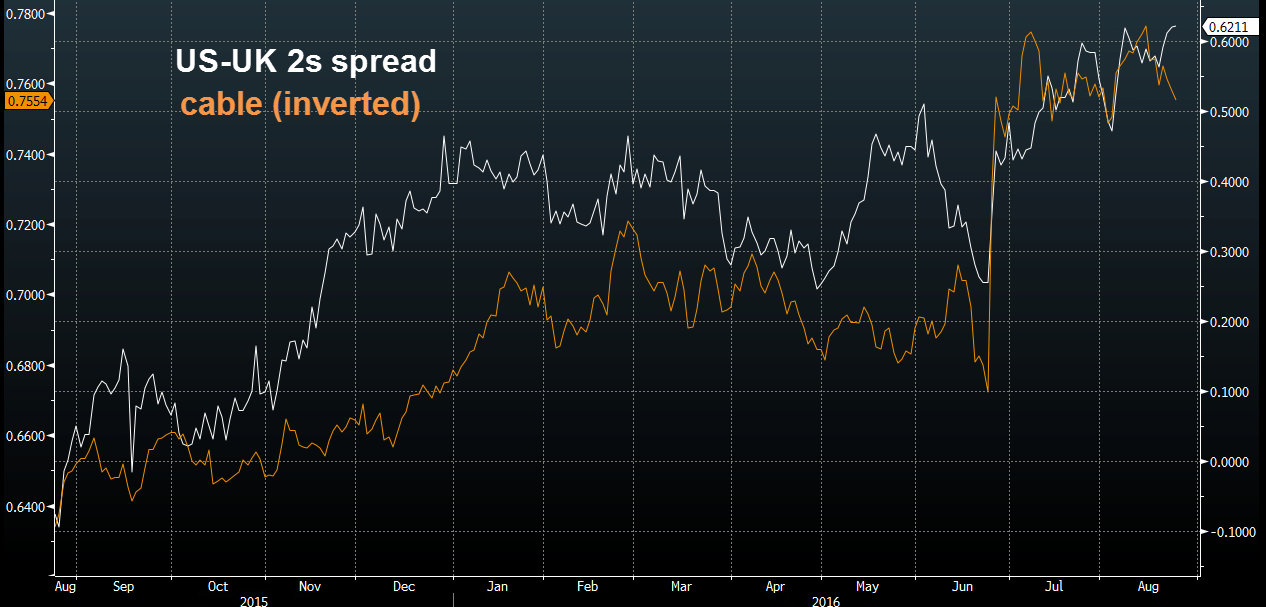

Charting the spread in 2s (currently at +61bps), we can see the relatively tight correlation with cable over the past year and over the past 5 years.

If anything, cable is a tad stronger at the moment than the historical relationship would suggest but relationships like this can disconnect for months at a time.