Goldman Sachs says the US dollar remains under substantial appreciation pressure

The latest note from Goldman Sachs on the US dollar:

"Following the more hawkish tone from the Fed at Jackson Hole, the Dollar has rallied around 1.5 percent versus the majors. While it remains an open question whether the Fed will follow through and hike at the upcoming FOMC, the recent strengthening highlights that the Dollar is a currency under substantial appreciation pressure, which asserts itself whenever the Fed steps off the brakes. For the FOMC, this is a genuine conundrum, because it means that too hawkish a message could send the Dollar sky-rocketing, a deflationary shock that would also weigh on growth, thereby - in a way - undermining the very rationale for shifting hawkish in the first place.

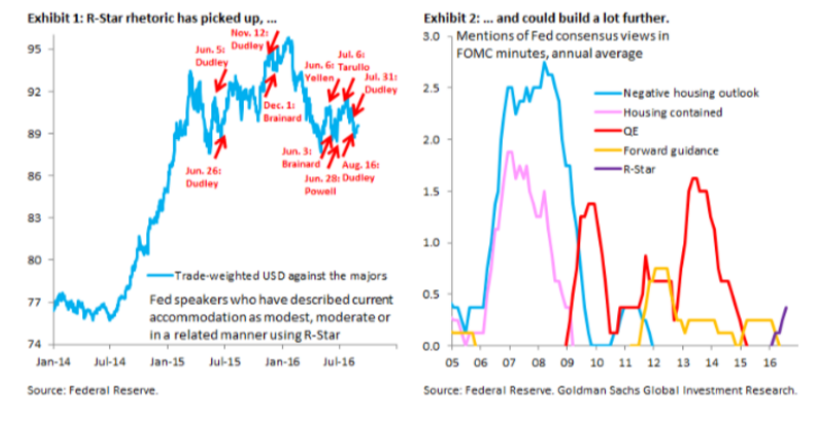

To deal with this conundrum, the framework that many at the Fed seem to be converging around is that "R-Star" is low, so that the degree of monetary policy accommodation is only moderate, despite policy rates being so low. In fact, the surge in Fed commentary in recent months around this idea is really quite remarkable (Exhibit 1), given that this has been quite a controversial concept in the past. For example, Vice Chair Ferguson in 2004 said that: "The confidence interval around the estimate is such that there was a 70 percent probability that the actual value of the equilibrium real rate was between 0.5 percent and 5.5 percent. Clearly, this estimate is not measured sufficiently precisely to be a useful guide to policy."

...In the end, we think it is important to stay focused on the big picture, which is: (i) the Dollar is under substantial appreciation pressure, which asserts itself periodically when the Fed shifts hawkish; (ii) as a result, the Fed is converging around the idea that R-Star is low, an idea that we see as driven by a desire to limit Dollar upside, by convincing markets that the size of this hiking cycle is small; and (iii) a pick-up in inflation will ultimately end this latest consensus episode, with the Fed taking its foot of the brakes whenever the US looks like it can tolerate some Dollar strength."

For trade ideas from banks, check out eFX Plus.