From Robin Brooks, Silvia Ardagna, and Michael Cahill at Goldman Sachs Macro Markets Strategy

This starts off slow but does get more interesting .... (ps. via eFX)

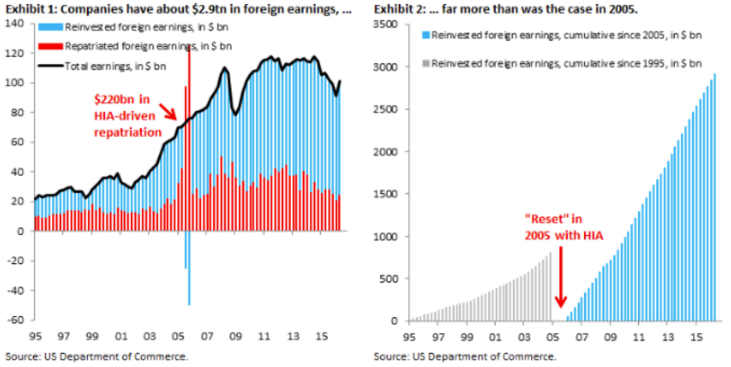

Corporate tax reform has been an especially hot topic since the US election. We look at the impact one component of that reform,a one-time low-tax holiday for repatriated earnings - often referred to as "HIA2," - might have on FX markets.

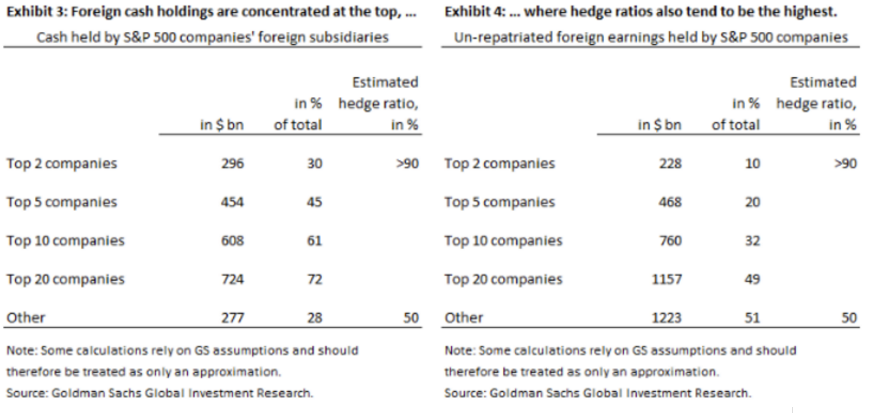

Our bottom line is that while the headline numbers seem huge (with $2.9tn in undistributed foreign earnings since 2005), the actual FX impact from a potential "tax holiday" is likely quite small.

When we go through the numbers, we note that the actual tax bill would be much smaller. But more importantly for our markets, we find that the vast majority - perhaps 80 percent - of "overseas" cash is probably held in Dollars already.

As a result, US Dollar cash and future revenues could probably cover the cost of the tax bill without any forced FX conversion. That is not to say that FX markets should ignore this area of policy completely. When we last discussed this topic, we emphasized that a "tax holiday" is likely only in the event of broader tax reform.

As our US team has highlighted, aspects of the House Republican blueprint - notably destination-based taxation - could have major Dollar implications. And as we discussed in our recent FX Views, we think the Dollar rally can extend much further if there is meaningful fiscal stimulus in an economy that is already close to full capacity.

We expect the USD to continue to move higher and we forecast the TWI USD to appreciate about 7% versus G10 currencies over the next 12 months.

Sterling, EUR and RMB downside are also positions we like In addition to USD strength, we also like some other idiosyncratic themes in G10 space.

Sterling downside has fallen out of favor, but we think Sterling remains one of the most actionable themes.

In mid-November, we went short Sterling and the Euro against the Dollar as one of our Top Trade for 2017