Here is Goldman Sachs on the GBp in the lead up to the BoE meeting Thursday

Comments from Goldman Sachs Macro Markets Strategy; Robin Brooks, Silvia Ardagna and Michael Cahill

A persistent preoccupation of the foreign exchange market is positioning, especially ahead of key risk events like tomorrow's Bank of England meeting.

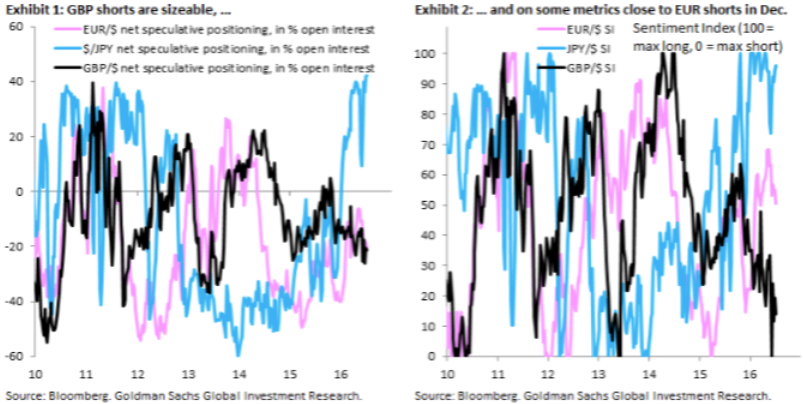

Exhibit 1 shows that speculative shorts in GBP/$ are 21.5 percent of open interest according to the CFTC's Commitment of Traders Report (CoT), the most sizeable short Sterling positioning (versus the Dollar) since early 2015. Our preferred metric - the Sentiment Index - transforms net positioning (in contracts) into an index between 0 and 100 based on min and max positioning on a three-year rolling window. Our Sentiment Index shows that Sterling shorts are comparable now to EUR/$ shorts ahead of the December ECB, which - on a disappointing meeting - caused a violent short-squeeze in EUR/$

There is no doubt that the build-up in speculative short positioning ahead of tomorrow's Bank of England meeting increases event risk into the meeting. But - especially in the case of the Pound after the Brexit vote - it is important to look at the bigger picture, which is that FX positioning can be a momentum or a contrarian signal.

Today's we updates those estimates and finds that stretched short speculative positioning in both cases still has a momentum signal, meaning that it tends to signal further weakening in these currencies versus the Dollar. On a four-week horizon our estimates put further GBP/$ downside at -1.0 percent, while on an eight-week horizon they put downside (cumulatively) at -2.4 percent, an estimate that is statistically different from zero.

In short, stretched short positioning for EUR/$ and GBP/$ has a momentum signal on average, suggesting further downside for Cable.

Our result obviously doesn't mean that a hawkish surprise from the Bank of England wouldn't matter. Obviously it would,which in many respects the December ECB meeting was a reminder of. But our economists do not forecast a repeat of that ECB meeting, which disappointed the market on action (the deposit rate was cut just 10bp with no signal for further easing, even after President Draghi had talked about "urgency" in bringing up inflation two weeks before) as well as on rhetoric.

Instead, even if the BoE stands pat, they expect dovish dissents from two MPC members and the minutes to be "exceptionally" dovish, essentially pre-announcing a rate cut and QE (leaning towards credit easing) for the August 4 meeting. The kind of about-turn that can fundamentally disorient the market, as it did for the ECB in December, is thus unlikely. As such, we see the momentum signal dominating short-term event risk into tomorrow, in line with our 3-month GBP/$ forecast of 1.20.