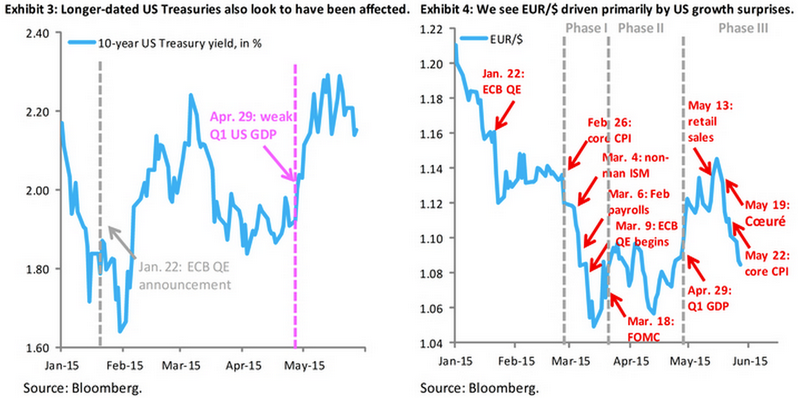

EUR/USD - Goldman Sachs sees three distinct phases, with US growth outturns versus expectations driving the bulk of price action.

--

3 Phases:

Phase I - Positive US growth surprises: "Following the ECB QE announcement on Jan. 22, EUR/USD settled around 1.14 for 5 weeks. On Feb. 26, higher-than-expected core CPI (for Jan.) caused EUR/$ to fall two big figures to 1.12. Subsequent days brought data that showed decent activity, ending with better-than-expected February payrolls on Mar. 6 and EUR/$ near 1.08. The start of ECB QE on Mar. 9 and associated curve flattening in the Euro zone took EUR/$ to 1.05 in the run-up to the March FOMC," GS clarifies.

Phase II - Uncertainty after the FOMC: "The March FOMC had all the makings of a Dollar-positive catalyst. In the wake of this meeting, USD appreciation ground to a halt, with EUR/$ cycling in a range from 1.05 - 1.10. An upbeat ECB press conference on Apr. 15, during which President Draghi emphasized the positive growth effects of QE, helped push EUR/$ to the top of this range by end-April," GS notes.

Phase III - Negative US growth surprises: "The weak first quarter GDP reading for the US on Apr. 29 began the unwind of the ECB QE trade, with EUR/$ and German Bund yields rising and the DAX falling on the day. Weak retail sales for April (May 13) raised fears that the Q2 growth rebound might be slow in coming, which were exacerbated by the surprise drop in consumer confidence for May (May 15). EUR/$ broke out of its 1.05 - 1.10 range and returned to its post-ECB QE level of 1.14, with broad Dollar weakness taking over against the majors," GS adds.

Findings:

"Given all the questions around the reliability of Q1 data as a gage for underlying activity in the US, we continue to see risk-reward biased in favor of a stronger Dollar, even now that EUR/$ has begun its journey back down," GS argues.

"From a fundamental perspective, the fact that the ECB QE trade would unwind on the back of a weak activity reading out of the US is somewhat odd. After all, a negative growth surprise - even if it comes from across the Atlantic - should raise the odds that low inflation in the Euro zone could stay entrenched, putting more pressure on the ECB to continue easing," GS adds.

Targets:

"As a result, we are inclined to see the recent sell-off in the ECB QE trade as a temporary squeeze, albeit a painful one. It remains our expectation that fundamentals will pull EUR/$ lower, in line with our 12-month forecast of 0.95. We expect the market to refocus on the European "growth crisis" in coming weeks, continuing to pull EUR/$ down," GS projects.