Gold commentary from Bank of America Merrill Lynch

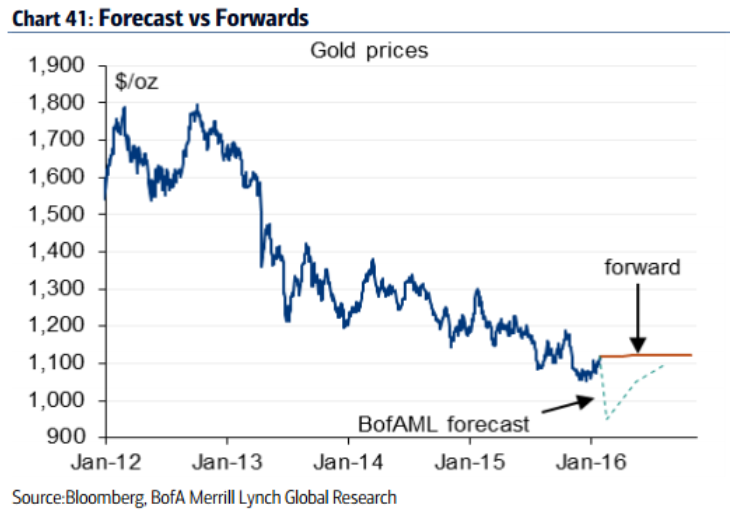

Themes: gold has rallied into the new year. We have been bearish gold since 2013 on a confluence of factors, including a stronger USD, falling oil prices, subdued market volatility and a bottoming out of real interest rates. Moving into 2016, we thought many of these trends, including tighter US monetary policy may continue to provide headwinds to the yellow metal. Yet, concerns over the health of China's economy and activity in the US have pushed prices higher. We see a risk that gold may give back some of these gains, if the immediate volatility subsides. Having said that, we remain steadfast in our expectation that this will be a transitional year, with gold ultimately breaking out of the bear market.

Forecasts: Gold to bottom out this year. While China continues to face severe structural issues, we see scope for a gradual stabilisation in the nation. This may ultimately remove some of the immediate upside to gold. Looking into the remainder of 2016, we believe the benign trading environment of the past few years is truly behind us, the pace of USD appreciation starts to slow and inflation could finally pick up in developed nations, all of which reinforce our view that gold will be bottoming out this year.

Risks: escalation in China. An escalation of issues in China and a deterioration of activity data in the US may put sustained upward pressure on gold prices earlier than we anticipate at present.

BofA targets gold at $1250 by the end of the year.

For bank trade ideas, check out eFX Plus.