The upper 1.33's has seen plenty of action but a break into 1.34 still looks like hard work

I'm slowly getting a feel for the markets after my break. It can often take me a couple of days to reacclimatise to the price action and I'm getting there slowly.

What I have noted first and foremost, is that we haven't broken into any major new ground in most pairs.

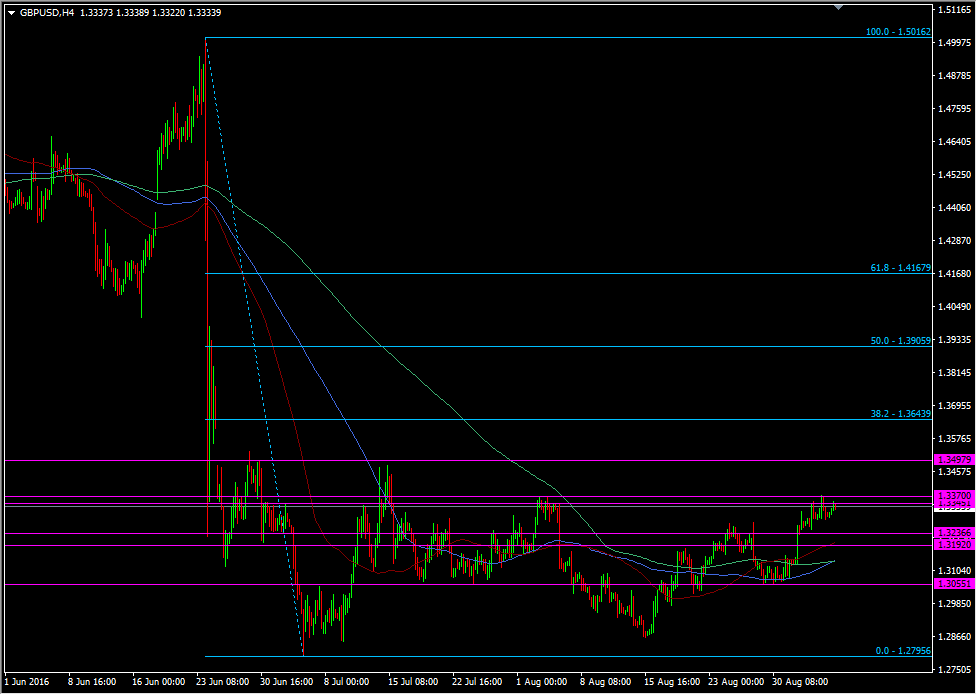

GBPUSD is one that is still within the recent ranges but it's still keeping its short term bullish tendency, now that things have calmed down a bit from the Brexit vote. We're not out of the woods by a long shot but the data has been showing that the UK ship hasn't sunk two months after the vote.

What is also obvious is that some better news is not enough to get pound buyers really attempting to take back some of the Brexit losses. We're still a long way off the 38.2 fib of the Brexit drop.

GBPUSD H4 chart

The nearest hurdle to get over is the 1.3370 & 1.3400 levels. 1.3370 is marking the potential for a short-term double top and if it holds over the next day or so, we can expect to see a deeper spill under 1.3300 than we've seen recently.

Right now I'm very much liking the look of the 1.3050 area for a long but might be tempted to hit a dip around those two H4 ma's at 1.3136/39, although they may have moved well apart by the time that happens.

For real fireworks, we need to break into 1.3400 and stay there, so we'd want to see decent support building around the big figure and down to what would then be the old resistance level at 1.3370. Fail that and down we go again.

A sustained move and hold below 1.33 will take some steam out of the recent rally but unless we crack 1.3200 also, the buyers won't be too worried.