Looking to end the week higher

The GBPUSD has moved to new session highs as London/Europe traders head for the exits. The pair has been helped by the worse than expected Michigan Consumer confidence data. Technically in the NY session there was a brief try to take the pairs price below the 200 hour MA before the Consumer confidence data, but that was reversed once the new data was released.

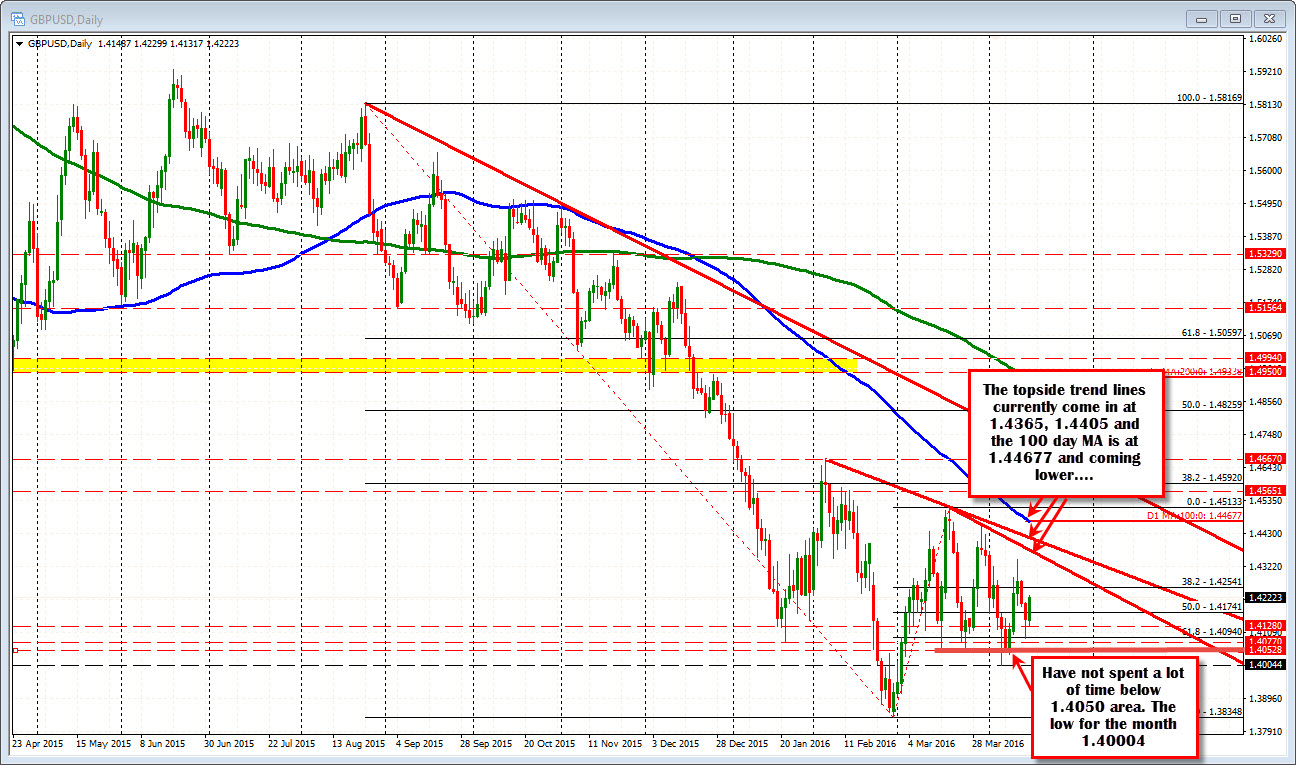

The extension has taken the price back above the 100 hour MA at 1.4206 and the 50% of the move down from the weeks high to the weeks low. That comes in at 1.42182 (see chart above). The high just extended to 1.42299. There is channel topside trend line cutting across at 1.4233 currently. There should be some reluctance to extend above that line but it is Friday.

In any case, the London traders are sending the pair out near their high for the day. For the week, the pair has increased about 100 pips (closed last week at 1.4121. The range was about 256 pips. We are around the middle of that range.

Looking at the daily chart, the low for the month held above 1.4000. The 1.4056 level had two separate swing low in the 2nd half or March. The lowest close this month was 1.4055. That level will be eyed next weeks should selling resume. ON the topside, the trend line cut across at 1.4365 and 1.4405. The 100 day MA is catching up to the price and is at 1.44677 (and moving lower).