It's not looking good for the pound

We can't say the signs weren't there about the 1.30 level. The slow crawl up from the test yesterday, the quick return back today. 1.30 still put up support over the last couple of hours but it's now gone in a rush. We've already seen resistance coming in at 1.2990, and now at 1.2980.

GBPUSD 15m chart

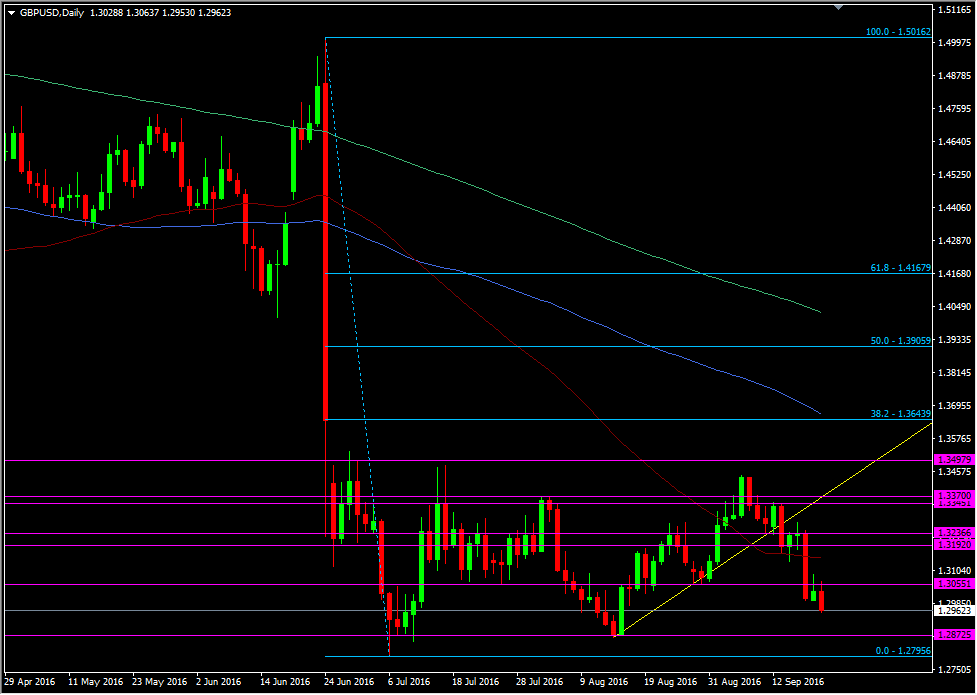

There's one big level I'm going to be watching on the downside and that's around 1.2860/75.

GBPUSD daily chart

This area marks the bottom of the current range since Brexit, just as the highs towards 1.35 have marked the top.

If that breaks then we could be on the verge of the next leg of this journey. This is a level I'm going to be interested in over the two central bank meetings. We're quite close to the lelev so negative news from the BOJ is going to hit yen pairs, and a surprise hike from the Fed will add more.

It's been my long held belief that the Brexit move was overdone but you can't argue with the price action. If we do get a Fed hike then I'm very interested in buying that GBPUSD dip as I believe that the Fed will go on hold again for many months, unless the data starts to show the economy really heating up. At the moment, it's looking like we're getting one hike a year. Once the market gets over any initial reaction, it will probably come to the same conclusion. At the very least that should remove some of the dollar pressure on the pair. The rest will be down to the UK, EU and BOE.

There's a lot of "ifs" to my view of longs but if they all line up in the way I'd like them too, I'm going to look to scale in longs for longer-term trade. Once we're over Wednesday's events I'll have a better idea of how I want to play it, if at all.