Forex news from US trading Tuesday October 27, 2015

- AUDJPY trade not doing so hot

- US Senate leader says import-export bank won't get floor time

- Buy the buck on dips - Credit Agricole

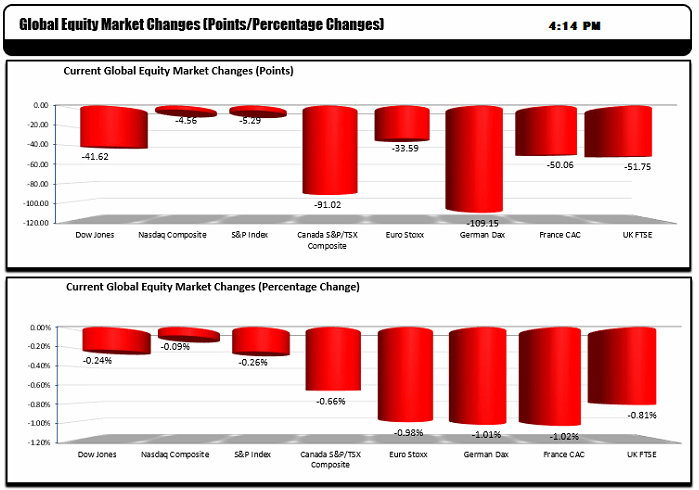

- European stocks take it on the chin today

- General level of interest rates will be lower than before says BOC's Lane

- US to sell off the family jewels under budget deal

- BOC Lane: Lower CAD boosting export competitiveness

- Pound and euro both lower on yen demand

- Congress has agreed a 2 year can kick says Boehner

- October 2015 US consumer confidence 97.6 vs 103.0 exp

- October 2015 US Richmond Fed manufacturing index -1 vs -3 exp

- October 2015 US Markit services PMI flash 54.4 vs 55.1 exp

- Tumble Tuesday for US stocks at the open

- Drop in oil prices heating up as we break 43.50

- August 2015 US Case Shiller 20 city house price index +0.1% vs +0.1% exp m/m

- Dollar finds some love from poor durable goods report

- September 2015 US durable goods orders -1.2% vs -1.2% exp m/m

- US Sept building permits data revised up to -4.8% vs -5.0%

The US durable goods data was the last major piece of domestic economic data before the Fed decision tomorrow and it certainly is not going to make the Fed anxious to "liftoff" tomorrow (or at least it should not). The data came in around expectations but revisions were not numbers that point to higher GDP. Trackers for 3Q GDP keep on moving lower and lower.

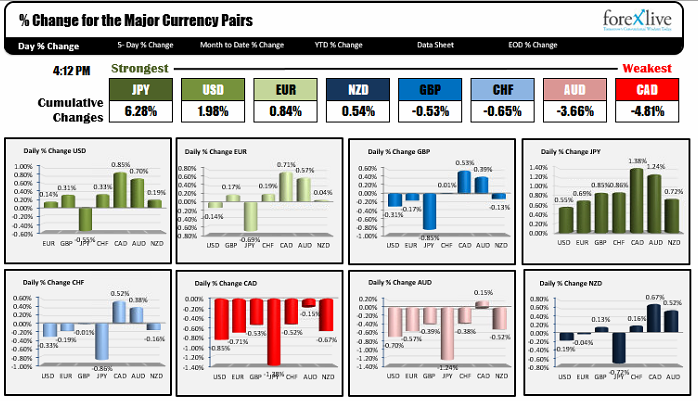

Despite the worse than expected data, the greenback found a way to rise against all the major currency pairs with the exception of the JPY

The JPY was the strongest currency today. There was officials early on saying the BOJ did not have to ease any further and that helped get the ball rolling . The USDJPY fell below the 200 day MA at the 120.97 after breaking and closing above the key MA on Friday. Yesterday the price closed above but was lower. Today traders gave up. Back in the meat of the 119.72-120.60 range (well more toward the topside but still in that range that defined trading in September and part of October.

The EURUSD did not do anything once again. Thursday and Friday of last week were like normal days of old, with great trading ranges (250 and 145 pips) . Yesterday (75 pips) and today (48 pips) were back to dullsville. The price has kept most of last weeks fall. So the sellers remain more in control. The 100 hour MA (at 1.1113 and moving lower) is catching up to the price. The 200 day MA at 1.1115 is another key level above that traders will be eyeing through the FOMC decision tomorrow. 1.0800-1.0860 remain a key target below if the bearishness is to continue.

The pound price action was to the downside in the NY session and the pair looks set to close the day below the 50% of the October trading range at 1.5307 and the 200 day MA at the 1.5331. Earlier this month there was a string of 7 days where the price traded above and below this moving average. There is a 3 day string now. With the FOMC decision not until 2 PM ET tomorrow and little economic news, the market may continue to hang around these levels.

The USDCAD continued to step higher and is trading at the highs at the end of the trading day. Lower oil prices are keeping the bid in the pair. WTI fell 1.32% in trading today. The pair is trading against a topside trend line at the close. If the pattern holds, do we get another 50% retracement?

AUDUSD is another commodity currency pair which is closing at an extreme (at the lows for it). The pair has now taken out the lows from last week (at 0.7181) and targets the 50% of the move up from the end of Sept low at the 0.71585. Remember the 9 straight up days from earlier in the month? Since that time, there has been 5 up days and 6 down days. The price has moved from a high of 0.7381 to a low of 0.7178 today. QoQ CPI data is out in the new trading day (8:30 PM ET/0030GMT). Estimate is for +0.7% QoQ.

FOMC decision at 2 PM ET. No press conference. No dot plots. No central tendencies. No expectation of a change. Does the Fed surprise the market? The question is "If they do surprise is it because of a liftoff or because they throw in the towel for 2015 and tell everyone to show up in 2016?". Although expectations are for nothing, be prepared for something - just in case.