Forex news for US trading on January 9, 2016

- Gradual but somewhat more regular hikes are warranted says Fed's Rosengren

- Rosengren: The US is in better shape than many trading partners

- Fed's Lockhart: We are quite close to achieving our dual mandate

- Fed's Lockhart: Forecasts two hikes in 2017, could see three

- UK Hammond: Aim to get Brexit talks completed by April 2019

- Fed's Lockhart: We are quite close to achieving our dual mandate

- Nigeria December oil output at 1.9 mbpd

- BOC Q4 2016 business outlook survey: Hiring intentions at best level since 2014

- December 2016 US labour market conditions index 1.2 vs 1.5 prior

- ECB QE count: ECB bought €10.993 vs sales of €4.725bn prior in PSP

- US consumer credit for November 24.532B vs. 18.35B est

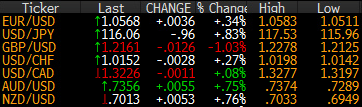

Markets:

- Gold up $10 to $1182

- WTI crude oil down $2.06 to $51.91

- US 10-year yields down 4 bps to 2.37%

- S&P 500 down 7 points to 2269

- JPY leads, GBP lags

The theme in the foreign exchange market on the day was pound weakness but it all took place in Asia and European trading. In New York hours the pound moved sideways in a 1.2119 to 1.2180 range with a few trips to either side before finishing near 1.2160.

The larger theme in US trading was USD weakness, especially early on. EUR/USD was chopping around 1.0520 as North America rolled in and it slowly climbed to 1.0580 through the London close and then finished just below. That's despite some hawkish talk from the Fed.

AUD/USD was another mover as it jumped up to 0.7375 from 0.7325 in a relatively quick move. The daily chart shows an outside bullish day and the pair has now climbed in four of the past five days.

Note that Japan returns from holiday on Tuesday. USD/JPY fell on Monday around the globe including a slip to 116.00 from 116.50 in US trading. Bids just below the big figure are holding so far.

USD/CAD put in an impressive performance. The pair finished nearly flat despite the 4% drop in crude. That's partly because the BOC business investment survey was universally strong and included some of the best metrics since early 2014. The release sent the pair to 1.3196 from 1.3240 but as the day wore on and oil fell further, it recovered to 1.3225.

Oil was the big story as it fell below $52 on all kinds of worries about North American production and even talk about the SPR lightening up.