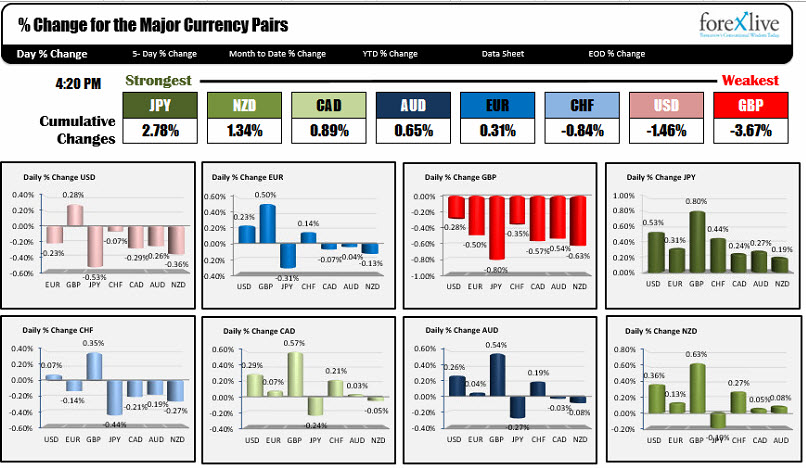

JPY is the strongest. GBP is the weakest

US 2Q productivity was weaker than expectations at -0.5% vs +0.4% expectations and that helped give the US dollar a softer tone in trading today. This was despite better data from wholesale sales which were stronger at 1.9% and wholesale inventories which increased by 0.3%. Despite the gains in inventories the Atlanta Fed GDP now estimate dipped slightly to 3.7% from 3.8%. Bond yields were lower in trading today after a few days of gains on the back of the stronger US employment on Friday.

Although the greenback did fall against all the major pairs (with the exception of the GBP - more on that pair later - it was the weakest currency for the day), the dollar declines were fairly modest. Let's take a look at some of the highlights and expectations for the new trading day.

EURUSD is ending the day above the 100 hour MA at 1.1109 (trades at 1.1115). Moreover, the pair is moving away from the 200 day MA at 1.1078. The pair was helped by a firmer EURGBP which is pushing toward to the July highs.

The GBPUSD did not fair as well. In fact, as mentioned above, the GBP was the weakest currency on the day. Against the greenback, the pair spend a lot of the trading day below the 1.3000 level although in NA afternoon trading, the action was above and below the key round number level. Although off the lows, the price remains below the 38.2% of the move down from yesterday's high. The pair is trying to see some upside corrective light, but it is not fully out of the woods just yet.

The USDJPY failed above the 200 hour MA over the last few days (at 102.076) but found support against the 100 hour MA at the 101.744 level. Stay in between those "goal posts" suggests the "market" is not really sure of the next move. Look for a break and run.

The USDCAD found support two separate times against the 100 and 200 hour MA at the 1.3108 level Key barometer for bullish/bearish in the new trading day.