Forex news for US trading on November 6, 2015.

- CFTC Commitment of Traders report: EUR shorts increase by 28K in the current weekly data

- US consumer credit rises by record 28.92 billion

- The fireworks sure were over quickly after the employment report

- Baker Hughes oil rig count 572 vs. 578 last

- The winner of our Non-farm payrolls competition was...

- Obama on Keystone rejection: It doesn't serve the best US interests

- European stocks go out with a whimper at the close of Friday trading

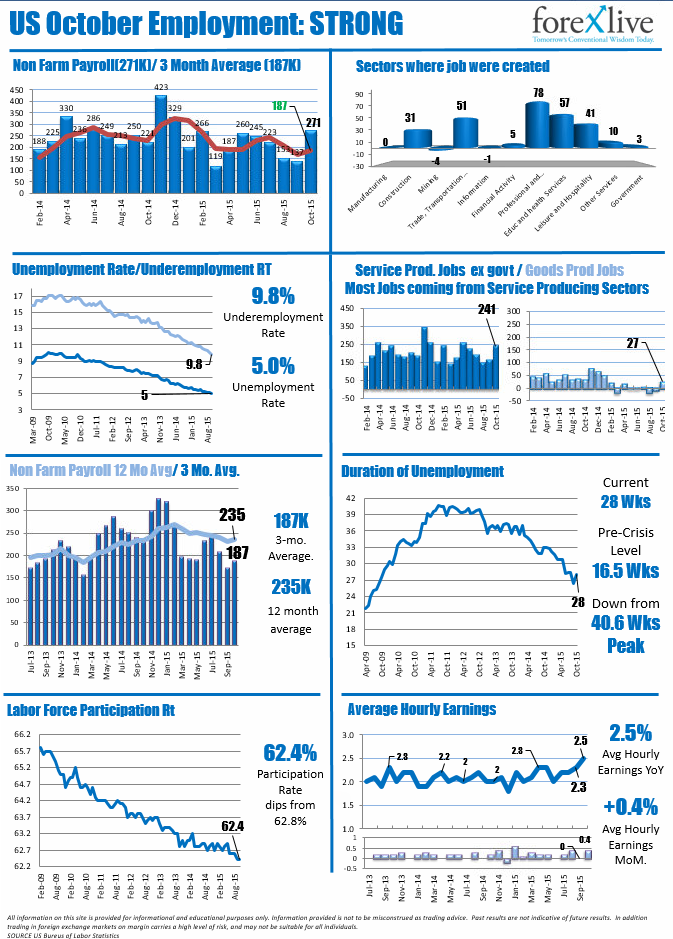

- Infograph: A graphical look at the US employment trends

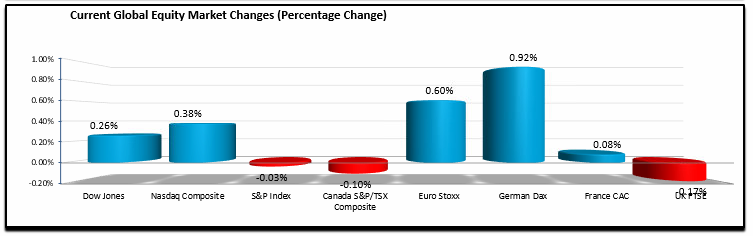

- US stocks make their moves after non-farm payrolls

- Economy effectively at full employment says Bullard

- Fed's Bullard sees clear skies for rate hikes

- Fed's Evans welcomes the good jobs number

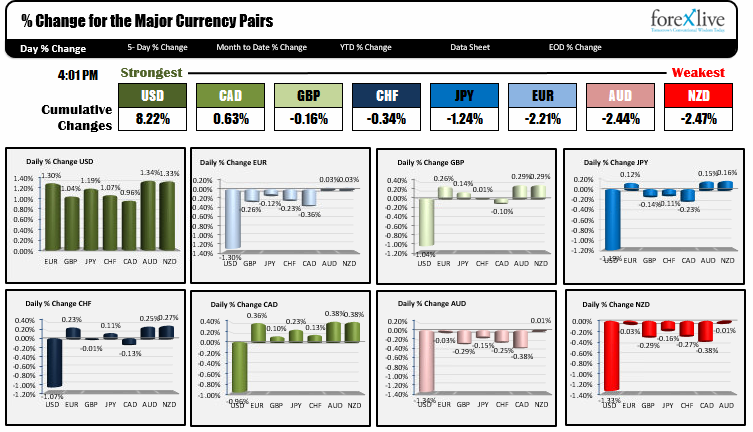

- Where to begin in as dollar cleans house?

- Canada net change in employment 44.4K vs.10.0K exp.

- October 2015 US non-farm payrolls 271k vs 180k exp

- Preview: NFP forecasts from 17 major banks

- Infograph: A graphical preview for the October US employment report

The US dollar surged in trading today after a stronger than expected US employment report. Non Farm payroll rose by 271K for the month. The revisions to the prior months were up 12K. The unemployment rate fell to 5.0%. The lowest level since March 2008. Hourly wages increased by a greater than expected 0.4%. The YoY rose to 2.5%. The Underemployment rate fell to 9.8%. Overall, a strong report. If the Fed is true to their word, a December liftoff is much closer than it was yesterday. Yes, there is one more employment report. Yes there is a little thing called inflation, but wages did rise more than expected and the Fed might be willing to look passed that. Can they tolerate a strong dollar? You can expect the next Fed speak might be in an attempt to jawbone the dollar lower. Be aware.

Unfortunately for traders who did not gamble on the number, the big chunk of the moves were in the first minute(s) of trading after the report. With the case of the EURUSD, the low was set in the 1st minute after the report at the 1.07016 level. The rest of the day was spent trading in a 50 pip trading range (1.0751 was the high), with an even closer range defined between 1.0720 and 1.0750. A move below the 1.0700 level will be eyed next week as the catalyst for further downside.

The GBPUSD was also on it's way lower before the report as traders continued the downside momentum from yesterday's BOE even before the announcement. Like the EURUSD the pair tumbled sharply lower (1.5029) rebounded to 1.5085 which was just below a May 2015 low, and made new day lows but only by a few pips. The GBPUSD fell around 470 pips from the Monday high. Next week, the 1.5000 level will be eyed. If the pair can get below it, there is scope for more downside. If not, there could be a correction back toward the 1.5200 and see what happens there.

The USDJPY is closing at the highest level since August 21. This week, the pair surged higher - moving away from the 200 and 100 day MAs in the process. The 123.38 level is the next upside target. Above that, traders will be looking toward 124.40-50 area.

The Canada employment picture showed a gain of 44.4K new jobs. However, 32K of those jobs were temporary election workers. As a result, the focus was on the dollars strength and the pair moved to 1.3300. This is the highest level since October 1st. Pres. Obama also announced that the Keystone pipeline will not proceed. Although it doesn't help, it was expected.

The AUDUSD and the NZDUSD also tumbled lower. The AUDUSD traded at the lowest level since October 2nd. The NZDUSD fell back below the 100 day MA at the 0.6575 level - increasing the bearish technical bias for that pair.

The chart below shows the change of the major currencies vs each other. For the day, dollar was the strongest. The NZD was the weakest (falling against all the major currencies)

The major stock indices were mixed. In the US the changes were minimal with the Nasdaq up 0.38% which the S&P declined by a scant 0.03%.

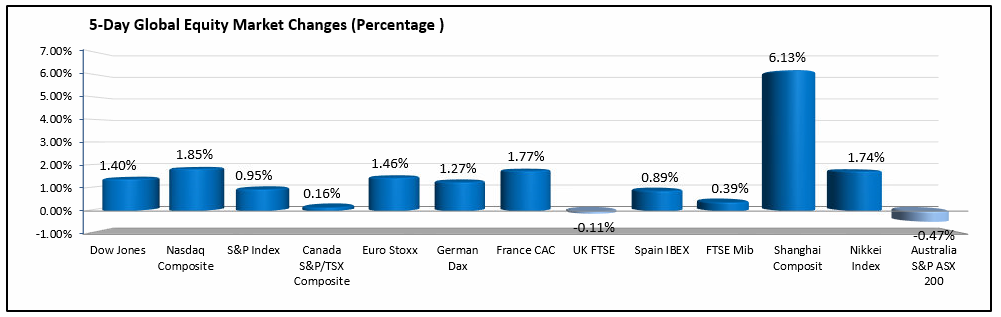

For the week, the Nasdaq composite rose by 1.85%. The Shanghai composite was the biggest gainer at 6.13% (see chart below).

Have a great weekend.