Forex news for US trading on November 5, 2015

- NFP leading indicator....NASAs hiring

- More Lockhart: Convinced that forces at work will give us price pressure

- Fed's Lockhart more hawkish in his comments from speech. Case for liftoff will continue to firm up

- OPEC is unlikely to cut oil output at Dec meeting if non-OPEC countries don't participate

- Goldman Sachs sees 184K, and raises to 190K

- Another intraday seesaw ride for European stocks

- Carney - Reasonably prudent to think rates will rise in 2016

- Was the market right or has the BOE caved in to pressure? What next for the pound?

- October 2015 Canadian Ivey PMI 53.1 vs 54.0 exp

- Central banks don't talk rates around the water cooler says Carney

- US initial jobless claims 276K vs. 262K est.

- Q3 2015 US labour costs prelim 1.4% vs 2.3% exp

- Carney cagey over prior rate comments

- BOE MPC does not have preference for inflation overshoot

- EU's Juncker sees no nominal debt haircut for Greece

- More from Carney: Last few days have seen quite a big retreat from risky assets

- BOE inflation report presser: Carney says UK growth to pick up from mid 2016

- October 2015 US Challenger layoffs 50,504 vs 58,877 prior

- BOE Inflation Report: GBP strength to continue dampening inflation after H2 2016

- Bank of England MPC votes to hike rates 1-8 vs 1-8 exp

It was the pounds day today. The BOE was more dovish in their statement (and Carney's comments too) and it set the tone for trading. That tone was focused on the pound. Other currencies seemed to be intent on letting the GBP do it's think and will wait around for the US employment report tomorrow.

In other fundamental news, productivity increased greater than expectations but at the expense of the less robust wage gains. Initial jobless claims were a little weaker. Fed's Lockhart spoke more hawkishly. He tends to me more centrist in his views. He is also a voting member.

The GBPUSD trended lower falling back below the 200 day MA at 1.5340. By the end of the day the pair had moved down to test the 1.5200 level. The low price from October 13th bottomed at that level. A move below that level in the new trading day will have traders looking to test the swing lows from May, June and September. The decline was helped by a big move higher in the EURGBP which saw this weeks weakness, reversed. The high on Monday was 0.7163. The low from before the BOE statement came in at 0.7041. The subsequent rally took the price all the way to 0.7159 - just 4 pips short of the Monday high.

The EURUSD went up, it went down. but overall the trading range in the NY session was only about 39 pips in total. The EURUSD has been hit down this week (prior to today) on the idea that the Fed would tighten. However, Chair Yellen did say yesterday that she was concerned about global growth. Well , the BOEs concerns about global growth, leaves the US the sole country looking to tighten sooner rather than later. That may exasperate the dollars rise if they did tighten. Does the Fed want that? Putting it another way, if the BOE is concerned about growth and inflation and global growth, shouldn't the Fed be cautious too? The EURUSD traders thought so today and also were encouraged by the support at the 1.0807-63 holding. That will be a key level through the employment report tomorrow too.

The USDJPY rallied to the highest level since August 21 but held against resistance at 122.02. The pair is closing right around the 100 day MA at the 121.74 area.

The USDCAD remained above the 200 hour MA for most of the day at 1.3148. Unless the price moves below that level, the buyers remain in control.

The AUDUSD moved and down with little change on the day. The NZDUSD benefitted from support at the 100 day MA yesterday at 0.6576. That key MA held and today traders covered some shorts as a result. When the price correction reached the low levels from the last week or so near 0.6644, the sellers returned and moved the pair toward the middle of the range.

It is all about the US employment report now. NFP is expected to rise by 183K. A number like that or better will keep the Fed in play for a December tightening. Having a >200K with positive revisions would be preferred.

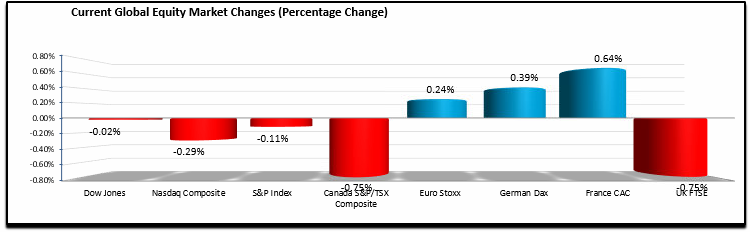

US stocks were down marginally on the day. The Nasdaq composite index was down -0.29%despite a strong showing from Facebook and Amazon who both now own market capitalizations of 300billion. Yes 300 BILLION.

The France CAC was the biggest gainer - up 0.64%.

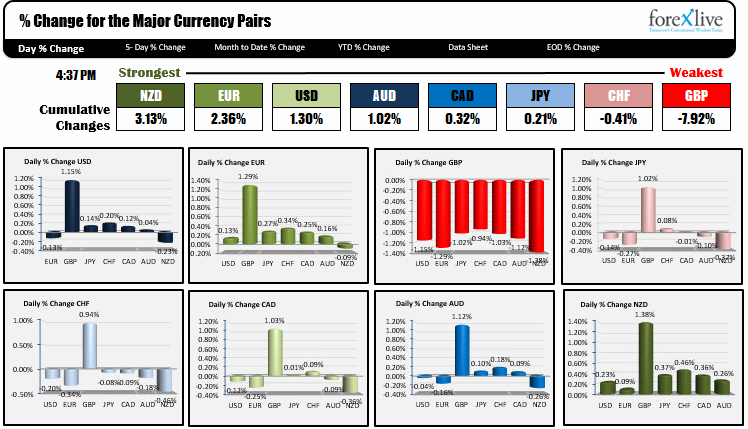

The below charts show the changes of the major currencies vs. each other. The GBP was down against all the major pairs. The NZD, which was the weakest yesterday, recovered today.