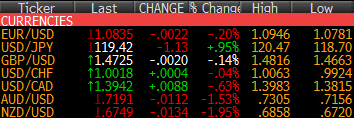

Forex headlines for US trading on Jan 4, 2016:

- December 2015 US ISM manufacturing PMI 48.2 vs 49.0 exp

- US November construction spending -0.4% vs +0.6% expected

- Canada Dec RBC manufacturing PMI 47.5 vs 48.6 prior

- December 2015 US Markit manufacturing PMI final 51.2 vs 51.1 exp

- Fed's Mester: US expansion is on solid ground

- Atlanta Fed GDPNow 0.7% vs 1.3% prior

- Fed's Williams says US economy is in very good shape

- ISM's Holcomb says survey comments show positives and negatives of oil slump

- December 2015 German HICP flash 0.2% vs 0.4% exp y/y

- UAE and Sudan both reduce diplomatic ties with Iran

- Gold up $12 to $1073

- WTI crude down 16-cents to $36.88

- US 10-year yields down 3 bps to 2.23%

- S&P 500 down 31 points to 2012 after touching 10-week low

- JPY leads, NZD lags

Markets started off the year in a sour mood. Chinese stock hit the skids and the negative sentiment went worldwide in a broad flight to safety that underpinned the yen and wrecked commodity currencies.

Early in Europe, the euro was higher but as sentiment deteriorated it began to slide and then the decline accelerated after German HICP. The euro dropped below the post-ECB low of 1.0796 to 1.0781 at the lows before a late bounce to 1.0834 as stocks pared losses.

Cable was also higher in Europe as it hit 1.4800 on good data but it was a quick turnaround and down to 1.4663 before a bounce to 1.4727 late.

USD/JPY steadily slid to 118.70 from 120.47 in Asia. The break of the big figure started quick selling that continued on risk aversion. After Europe went home, sentiment began a long, slow improvement and we finished 70 pips above the lows.

USD/CAD was caught in a tough spot early. Oil was higher on Saudi tensions but other commodities were lower and risk aversion was the theme. USD/CAD chopped around 1.3900 the fell to 1.3875 to the lowest levels since the open. But oil collapsed on supply rumours and then USD/CAD shot to 1.3981.

AUD/USD had been in a quiet march higher over the holidays but it was unwound in the blink of an eye as 61.8% of the rally evaporated and the Nov 22 low gave way. After breaking those key levels, AUD found a bid on risk sentiment and recovered to 0.7190, 40 pips from the lows.