Forex news for New York trading on August 31, 2016:

- Canada Q2 GDP (annualized) -1.6% vs -1.5% expected

- ADP August employment +177K vs +175K expected

- US EIA weekly oil inventories +2276K vs +1300K expected

- US July pending home sales +1.3% vs +0.7% m/m expected

- Chicago PMI 51.5 vs 54.0 expected

- Restaurant Performance Index rises slightly in July

- Bill Gross: The Fed will hike rates on Sept 21

- Brazil's Rousseff impeached, will likely appeal to Supreme Court

- UK PM May says will push ahead with Article 50 without Parliamentary vote

- OPEC output rises in August - RTRS survey

- Fed's Kashkari: The Fed is letting the economy grow without overheating

- Kashkari Q&A: Labor force participation has fallen further than we expected

- ECB's Villeroy: ECB bashing is exaggerated

Markets:

- S&P 500 down 5 points to 2171

- US 10-year yields up 1 bps to 1.58%

- WTI crude down $1.59 to $44.76

- NZD leads, JPY lags

The calendar was busy on Wednesday and it started with some hawkish comments from Rosengren that put a bid under the US dollar as New York was arriving. The main event was ADP though and it left markets without any answers as it virtually met expectations.

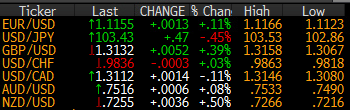

EUR/USD bottomed at 1.1124 just after ADP and slowly climbed to 1.1160 in what turned out to be an unenthusiastic month-end trading session.

USD/JPY held a bid even as larger USD demand faded. The pair finished at the highs and just under 103.50 as it finished the month strong.

Cable was a mess. It jumped in Europe but then quickly faded after ADP and hit 1.3080 then it bounced to 1.3135 then fell back to 1.3090 and the finished at 1.3132, up a half cent on the day.

USD/CAD was strong but perhaps not as strong as the weak performance from oil would indicate. It rose early from 1.3090 to 1.3140 but trailed back to 1.3115.

Oil sank after the EIA data, dropped to $44.80 from $46.05 in the worst drop since the first trading day of the month. I wrote about the (dire) September outlook for oil here.