Forex news for trading on March 29, 2017.

- US major stock indices mixed. Broader market up. Dow down.

- US Crude oil settles at $49.51 /bbl

- Feds Williams: Much of dollar rise due to relative strength of US economy

- UK PM May: We may be prepared to pay into some EU programs

- Fed's Rosengren: Now is the time to think about how to normalize more quickly

- Fed's Williams: More than 3 hikes in 2017 possible given upside risks

- Like out of a textbook

- Fed's Rosengren: I'd be surprised of long-end didn't respond to hikes

- Take a moment to marvel at the low costs in financial markets (and where it's headed)

- European stocks unperturbed on Article 50 day

- EU's Verhofstadt: We cannot accept that the UK would start bilateral trade talks before leaving the EU

- Fed's Rosengren favours a hike at every other FOMC meeting this year

- Oil bounces on inventory data but it still has a big hill to climb

- Fed's Evans on hikes again: 2 is safe, 3 could happen, 4 would need better fundamentals

- With Brexit now triggered, here's what happens next

- Weekly EIA US crude oil inventories +867K vs +2000K expected

- Fed's Evans says he doesn't know yet when Fed will shrink its balance sheet

- US Feb pending home sales +5.5% m/m vs +2.5% expected

- Fed's Evans: Repeats that he supports one or two more hikes this year

- Here's Theresa May's Brexit letter to Donald Tusk in full

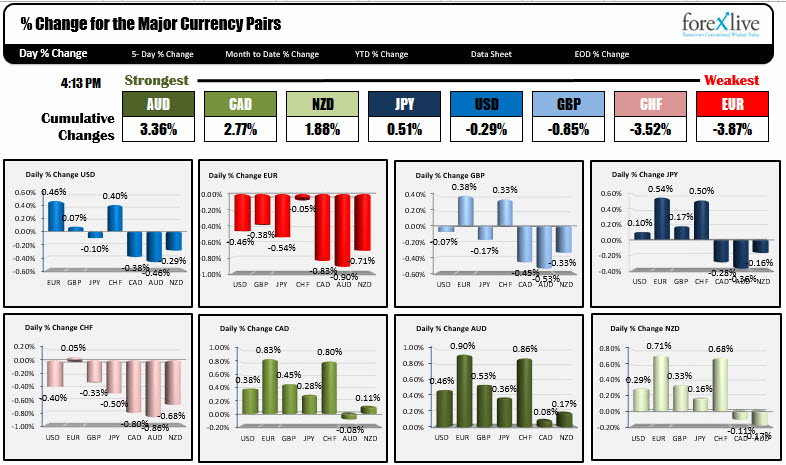

- The strongest and weakest currencies as NA traders enter for the day

In other markets:

- Spot gold up $0.91 or +0.07%

- WTI Crude oil +$1.09 or +2.25%

- US stocks are mixed: S&P up +0.11. Nasdaq up +0.38%. Dow down -0.20%

- US debt yields lower. 7 year auction was strong. 2 year 1.269%, -3.1 bp. 5 year 1.927%, -3.5 bp. 10 year 2.38%, -3.7 bp.

- European stocks ended higher: German Dax up 0.44%, UK FTSE up 0.41%, France CAC up +0.45%, Spain Ibex -0.21%

Today was the day for the Article 50 trigger and indeed it happened. Actually the letter was signed at the start of the trading day (in the Asian session) and delivered later in the European session. PM May spoke on it as did other officials in the UK and the EU. Needless to say, it was old news, the process is just beginning. There will be jockeying for position, many meetings will take place. There will be ebbs and flows from both sides. What will make it difficult is the EU has to make it less than what they have now - or so you would think that might be a goal. Of course it will be country vs UK negotiating trade terms. So things could get muddy. Overall, it will be a mess but day 1 is over and the world did not blow up. In fact the GBP was mixed.

In other news today, Fed speakers (Evans, Rosengren, WIlliams) are on board for more hikes in 2017. That was a little supportive to the dollar, but I can't say the comments were really "market moving". Pending home sales in the US came in much better than expectations at 5.5% vs 2.5% est. It really did not move the needle much.

The DOE Crude oil inventories increased by 867K, but that was not as great as the 2000K estimate. The "better number" (it was still an increase) sent oil prices were up over 2% on the day and that helped to send the USDCAD through the 100 and 200 hour MAs at 1.3365 and 1.3354 respectively. The low reached 1.3321 - right around the lows from Monday's trading. A move below that level will have the pair targeting the 100 day MA at 1.32935. Last week, the price fell below the MA level for a few hours, but then shot back higher. Look for buyers on a test of the key MA level.

In the EU in a well timed ("well timed" because it came on a day that might have been more supportive to the EUR especially against the GBP), "sources" headline that read: "ECB POLICYMAKERS WARY OF MAKING FRESH POLICY-MESSAGE SHIFT IN APRIL, WORRIED ABOUT POTENTIAL YIELD SURGE - SOURCES", sent the EUR pairs lower. That headline - and some more bearish technicals in the EURUSD - pushed the EURUSD and EURGBP lower. The EURUSD fell by nearly 0.5% on the day and in the process fell below the 200 hour MA at 1.0798. The low for the day reached 1.0740. There is good, good support at the 1.0700-06 in the new trading day. Be aware for lurking buyers on a test. For the EURGBP, the pair moved higher in the Asian session (up to 0.8734), then tumbled on the news all the way to 0.8672. The pair settled the day right around the 100 and 200 hour MAs at 0.8654-59 - a safe zone for the pair.

So what about the GBPUSD? The pair spend the first day of post Article 50, trading between a couple 200 bar MAs. On the tops sits the 200 bar MA on the 4-hour chart at 1.24677. On the bottom sits the 200 hour MA at 1.2378 (the price peaked slight above and slightly below each extreme but quickly rejected to moves). IN between both those levels is the 100 day MA at 1.2418. The market trading above and below it in the NY session without much care that it was there. Let's just say, it acted like a neutral area for the pair. In the new trading day, look for momentum nuances that might say the buyers or sellers are taking control. The expected bias would seem to be lower, BUT the market is pretty short GBP (at least that is what the commitment of traders says). So you have to be careful. A short squeeze (i.e. getting above the aforementioned 1.2468 level) could materialize given the right push. Watch the levels.

Below is a snapshot of the strongest and weakest for the day. The AUD was the strongest, while the EUR was the weakest.