Forex news for January 29, 2016

- US Q4 advance GDP +0.7% vs +0.8% expected

- Canada GDP for November comes in at 0.3% MoM (est 0.3%)

- US advance goods trade balance Dec -$61.51bln vs -$60bln exp

- Fed's Kaplan: Message from FOMC is that more time needed to assess

- ISM makes small revisions to December manufacturing and non-manufacturing indexes

- Baker Hughes US oil rig count 498 vs 510 prior

- U Mich Jan final consumer sentiment 92.0 vs 93.0 expected

- Chicago January PMI 55.6 vs 45.3 expected

- Jan ISM Milwaukee 50.36 vs 50.00 expected

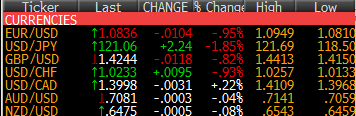

Markets:

- Gold up $2 to $1117

- WTI crude up 42-cents $33.64

- US 10-year yields down 5 bps to 1.93%

- CAD leads, JPY lags badly

- On the month, USD leads, NZD lags

A big question midway through the month was if central banks 'get it'. That doesn't explain all the worries in markets (commodities, China, especially) but it's an important part of the equation. In the past 8 days, the ECB, Fed and BOJ have all delivered a more dovish tone.

That was underscored late today by the comments from Kaplan. The US GDP report also cooled some concerns about the consumer. The Chicago PMI also snapped back.

The big driver was the BOJ and yen crosses absolutely soared. USD/JPY started US trading at 120.80 and held a steady bid. It eventually took out the post-BOJ high of 121.42 and rose to 121.69 at the options cut. It slipped from there and then fell hard at the London fix as it dipped below 121.00. It was a sideways chop from there into the close.

The euro was under heavy pressure amid broad based US dollar demand. EUR/USD was flat for the first hour of US trading but it slipped below the Asian low of 1.0885 and then tumbled to 1.0810 as month end fixing sales weighed. Last at 1.0836.

Selling in EUR/CHF after it hit 1.1165 might have been part of the equation. That pair skidded down to 1.1060 into the London fix.

Cable whimpered to the finish line after a poor month. It was under heavy selling pressure into the London fix as it hit 1.4160 and then a second wave of selling 30 minutes afterwards it more stops just below 1.4150. It was a stead recovery after Europe went to the pub as it rose to 1.4245 but it was still a 115 pip decline on the day.

USD/CAD finishes the day down 30 pips at 1.4000 but there were some big twists and turns along the way. The pair fell down to 1.3970 as oil rallied but an official Iranian denial of the OPEC 'plan' to curb production 5% sparked a reversal and as oil fell into negative territory, USD/CAD it 1.4109. Late in the day, however, sales knocked it back to 1.4000 in a wild month for the pair.

AUD/USD dipped to a session low of 0.7055 from 0.7080 at the start of US trading. It was a lackluster session for the Aussie to finish the week and it ended the day where it started.