Forex news for trading on Dec 28th 2016

- Crude oil settles at $54.06 per barrel

- Stocks trading at session lows

- Down goes the USDJPY.....

- US sells 5 year note at a high yield of 2.057%

- EURUSD cracks to new session lows as London traders head home.

- UK FTSE 100 ends at record high close

- Forex technical analysis: EURGBP tests 0.8500 support

- Forex technical analysis: EURJPY falls away from the 100/200 hour MAs

- US pending homes sales -2.5% vs +0.5% estimate

- US stocks open higher but reverse course

- Forex technical analysis: EURUSD gives in to the stronger dollar

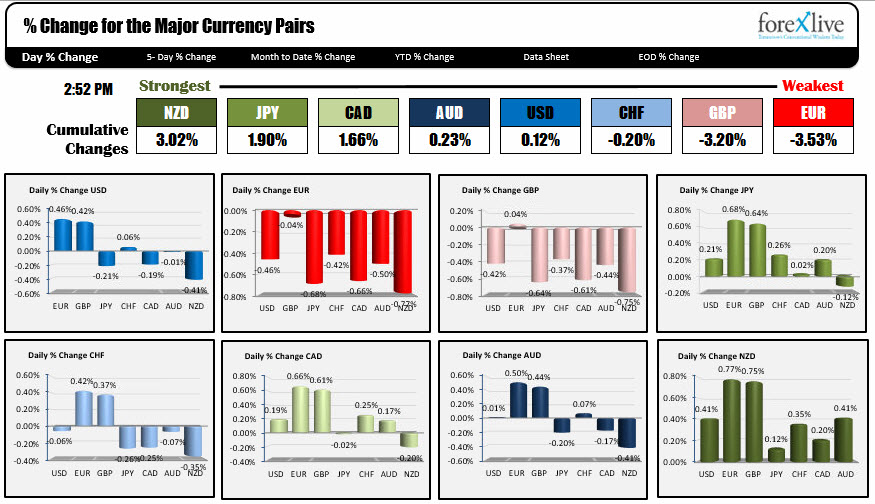

- The strongest and weakest currencies as NA traders enter for the day

In other markets at 3 PM:

- S&P down -0.77%

- Nasdaq down -0.85%

- Dow down -0.49%

- Crude oil, +0.13%

- Spot gold +0.22%, Silver +0.12%

- US yields mixed with 2 year up 3.3 BP and 10 year down -4.6 BP

US pending home sales were the only economic data out in trading today and it showed the impact of higher mortgage rates, low inventory and a decrease in affordability. They fell by -2.5% vs expectations of a 0.5% increase. The downside of the Trump rally is the surge in rates and the US dollar and how the economy weathers those storms will pave the path for rates, the Fed, the dollar and the stock market in 2017. Right now, the market has priced in a lot of good news and today's news was a bit of a punch in the stomach.

Having said that the dollar was still mixed today. Looking at the % change snapshot, the USD did rise vs the EUR and the GBP, but fell or was unchanged vs. the other major currencies and although the dollar was higher against the EUR, the pair has rebounded from a low of 1.0371 to back above the 1.0400 level. What will continue to be important for that pair from a technical perspective is the 100 and 200 hour MAs at 1.0430-41 area. Stay below on a correction and the sellers are still more in control.

The USDJPY traded at the lowest level in 5 trading day (since Dec 20th). It too fell below the 200 and 100 hour MAs at the 117.48-60 area and that is now topside resistance/risk for shorts. ON the downside, the 117.00 and then 116.53 (low from last week) are hurdles that remain challenges for this pair.

The GBPUSD fell to the lowest level since October 31st but the 1.2200 level stalled the fall. In the new day, a move above the 1.2227 is step one for any rebound ideas. We traded above that level during the NY session but could not close an hourly bar above it (in the NY session at least). That level - by the way - was the low from last weeks trading. Above still looms the 100 hour MA which has not been breached since FOMC day on December 14th. That MA comes in at 1.2284 currently (and moving lower). Keep that MA in mind going forwarrd.

The USDCAD fell off a bit today and moved closer to the 100 hour MA at 1.35112. The price of the USDCAD move a few pips below that MA line last Wednesday but in reality, there has not been much trading below that line since Dec 14th - this despite moves higher in oil.

The AUDUSD tried to extend above it's 100 hour MA in Asian Pacific trading, but failed quickly (at 0.7200 now). A move above that level is needed to push the bias more to the upside for that pair.

Not much in the Asian calendar to look forward to with BOJ summary of opinions from the Dec 19-20 meeting.

Have a great new day!