Forex headlines for US trading on Nov 25, 2015:

- October 2015 US durable goods orders +3.0% vs +1.5% exp m/m

- Final University of Michigan Sentiment for November 91.3 vs. 93.1 est

- October 2015 US new home sales 0.495m vs 0.500m exp m/m

- November 2015 US Markit services PMI flash 56.5 vs 55.0 exp

- September 2015 US FHFA house price index 0.8% vs 0.4% exp m/m

- US PCE core for Oct. 0.0% vs. +0.1% est. PCE deflator 0.1% vs. +0.2% est.

- US initial jobless claims w/e 21 Nov 260k vs 270k exp

- US Personal income 0.4% vs. +0.4% est. Personal spending 0.1% vs. 0.3% est.

- Germany gives Greece 10,000 ways to cut its deficit

- Goldman Sachs says the US stock market will be flat in 2016 but they have 16 picks

- Baker Hughes US oil rig count 555 vs 564 prior

- Turkey releases recording telling Russian jet to change heading

- JPMorgan cuts Q4 GDP tracker to 2.0% from 2.5%

- US sells 7-year notes at 2.013% vs 2.030% WI

- Dallas Fed trimmed mean PCE prices index +1.3% annualized in Oct

- Atlanta Fed slashes GDP forecast

- US EIA weekly oil inventories 961K vs +1000K expected

- SNB's Jordan says negative interest rates have proved very useful

- ECB to increase QE to €75bn per month - Reuters Poll

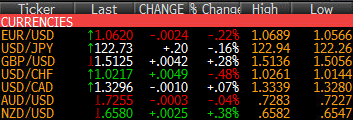

Markets:

- NZD leads, CHF lags

- Gold down $5 to $1070

- WTI crude up 23-cents to $43.10

- US 10-year yields down 0.7 bps to 2.23%

- S&P 500 flat at 2089

The Reuters ECB exclusive was the big story in Europe and it knocked the euro down 120 pips from where it was at the end of Asian trading. The final push came on the U Mich and new homes sales data (or options related buying) as the euro hit a seven month low of 1.0565. it didn't last long and a short squeeze on profit taking into the US long weekend pushed it all the way back up to 1.0640. Last at 1.0619 as the day wound down in quiet fashion.

USD/JPY rose on to 122.94 at the options cut in a continuation of a move from 122.28 at the start of European trading. Opportunistic USD buyers were out in force despite US 10-year yields hitting a three week low. There's an idea out there that USD longs will soon take profit but the buyers are still in control.

Cable bounced after three days of solid selling. It retested yesterday's low in Europe and held the line. That was a signal to buy and it climbed 60 pips from the lows to 1.5121 before a second fall to 1.5067. The lows held again and that marks a small series of higher lows, which is a good signal for the rest of the week.

USD/CAD tracked oil but was tied to a 40 pip range. Oil was down 2.5% as US traders arrived but the inventory and Baker Hughes reports were positive and crude finished slightly higher. USD/CAD followed the track, rising to 1.3335 from 1.3290 only to fall back to where it started later.

Australian capex data is in focus later. Soft construction work numbers hurt the Aussie along with general USD strength but it founds its legs ahead of 0.7225 and is back up to 0.7258. At least one analyst likes AUD/USD longs near here.

New Zealand trade balances numbers are due up shortly with the kiwi sitting near session highs at 0.6580.