Forex news for US trading on May 25, 2016:

- Bank of Canada holds rates at 0.50%, as expected

- April 2016 US advanced goods trade balance -57.5bn vs -60.0bn exp

- Fed's Kaplan backtracks on June/July rate hike advocacy

- Rumors of forced liquidation in agricultural futures

- Fed's Kaplan laments high US debt and aging population

- Fed's Kaplan: High debt to GDP are a headwind

- April 2016 French jobseekers -19.9k vs 4.5k exp

- EIA weekly US crude inventories -4226k vs -2000k exp

- May 2016 US Markit services PMI flash 51.2 vs 53.0 exp

- Fed's Harker says things seem stable in China

- March 2016 US FHFA house price index 0.7% vs 0.5% exp m/m

- ECB's Praet says main concern is an erosion of trust in globalisation

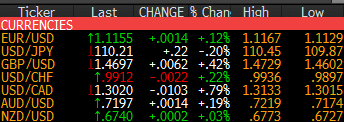

Markets:

- Gold down $3 to $1224

- WTI crude up $1.07 to $49.71

- S&P 500 up 14 points to 2090

- US 10-year yields flat at 1.86%

- CAD leads, JPY lags

The Bank of Canada decision was expected to include a hint of dovishness but it was largely neutral and that sent USD/CAD lower. The declines extended as oil prices pressed towards $50 per barrel. During the session, the pair fell more a full cent to 1.3013 and closed at the lows.

EUR/USD made a fresh two month low in a dip to 1.1125 but it quickly rebounded to 1.1155 and then chopped sideways to finish the day slightly higher.

USD/JPY climbed in Europe and was boosted by continued upbeat stock market sentiment and solid US data. However offers at 110.45/50 ahead of the May high proved to be too much and the pair slipped back to 110.14.

Cable continues to rally on fading Brexit fears. The pair broke 1.4700 late in European trading and then chopped sideways.

The Australian dollar traded within the Asia-Pacific session range in European and US trading as it consolidated around 0.7195. The market is uneasy about China and what's coming next with the yuan.

Please take a moment to fill out the ForexLive feedback survey