Forex news for trading on March 22, 2017

- RBNZ holds rates at 1.75%, as expected

- US broad market indices end the day with gains

- RBNZ decision due. What levels to eye.

- Sometimes a vote isn't just a vote (or maybe it is)

- Sterling positioning data is dead giveaway of a crowded trade

- Italy plans to raise 2017 growth forecast - report

- UK confirms four dead in terror attack including police officer and attacker. Update: Attacker named

- S&P index tests the 38.2% retracement level today and bounces

- Nunes says 'incidental' surveillance on Trump and his team provided 'significant information'

- Europe claws its way back from the lows

- Should we care about the Obamacare vote on Thursday? - Credit Agricole

- EU's Barnier: The second best relationship for the UK is the EEA

- This is the saddest corporate story you will read today

- EURGBP sellers into the London fixing (or so it seems)

- British police are treating Parliament attack as terrorism

- UK Parliament shooting: 1 attacker killed, several injured

- EU's Barnier: Divorce with Britain comes first & future relationships after

- Pound hits session low after reports of shots fired outside UK Parliament

- US weekly EIA oil inventories +4954K vs +3000K expected

- SNB moves the goal posts on CHF indices

- February US existing home sales 5.48 vs 5.55m expected

- USD/JPY isn't looking pretty but the 10-year is still in charge

- January 2017 US FHFA HPI 0.0% vs 0.4% exp m/m

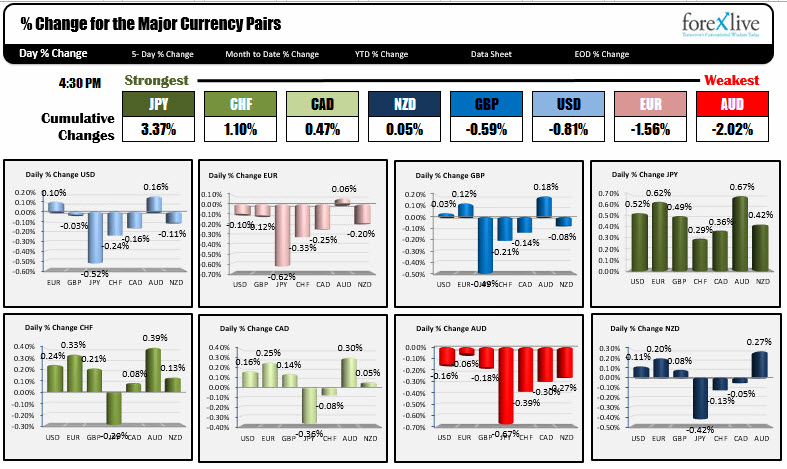

- A snapshot of the strongest and weakest currencies

In other markets:

- S&P index +0.19%. Nasdaq +0.48%. Dow down -0.03%

- 2 year yield down 1.4 bp. 5 year yield down 1.6 bp. 10 year yield down 1.9 bp but off low levels by about 2 bps

- Spot gold was up $3 or +0.25% to $1247.72

- WTI Crude recovered from a low of $47 to trade near unchanged ($48.14).

Today, in the NY session the markets focus was on the developments in London from a reported terrorist attack on the Houses of Parliament and the city in general. Some twenty people were injured with four dead including a police officer and the terrorist himself. Details are still being hashed out as to responsibility but the authorities are treating the attack as a terrorist act.

The other event that had the market on edge is the vote tomorrow on the repeal of Obamacare. A defeat could certainly weigh on the stocks and lead to selling of the dollar, and a potential flight into treasures (depending on the stocks of course). That could have the market trading sideways in the new trading day.

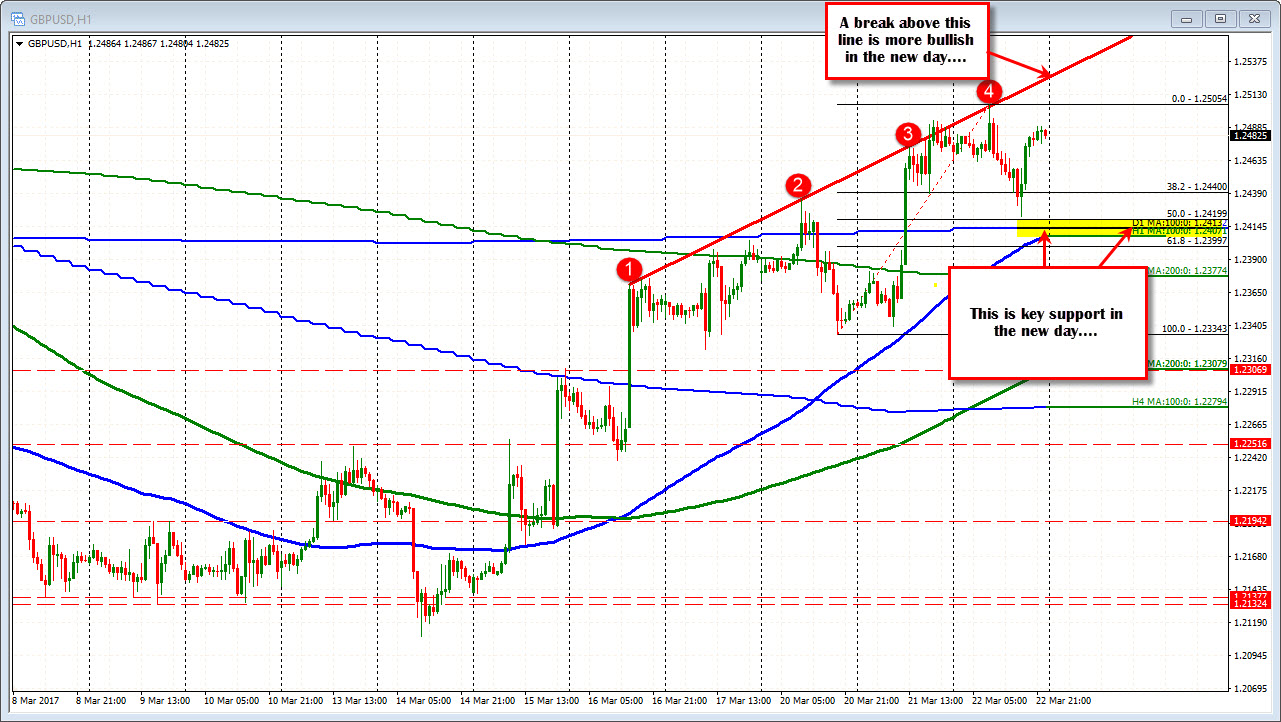

The GBPUSD fell on the news and tested a key support area defined by the 100 day MA at 1.2407 and the 50% of the move up from the Friday low at 1.24199. The low reached 1.24217 before rebounding back higher. The retracement and MA will be key support in the new trading day (see chart below). The afternoon high extended to 1.2489 short of the natural resistance at 1.2500. On a move above 1.2500 in the new day, there is a topside trend line that was broken yesterday but then reestablished as resistance. Look for bullish or bearish clues on a break or successful test of that line.

The USDJPY fell below the 111.00 level twice today but is ending the day back above the natural technical level. The 100 day MA was broken last Thurday, and the pair has moved lower over the last 3 trading days. The low today traded at the lowest level since November 22nd (110.728 was the low today). If the pair can find support above the 111.00 level there might be a corrective rally back toward 111.56 but I would expect sellers ahead of that level into the Trump vote tomorrow. Look to sell against that risk level for a trade.

The EURUSD found sellers once again in the 1.0819-28 area. The 1.0819 is the 50% of the move down from the November election high. The 1.0828 was the spike hike from Feb 2 that was quickly rejected. A move above that line is more bullish. ON the downside a rising trend line has been broken on a few occasions but reestablished as well. If there is momentum below, then look for more selling. (see chart below).

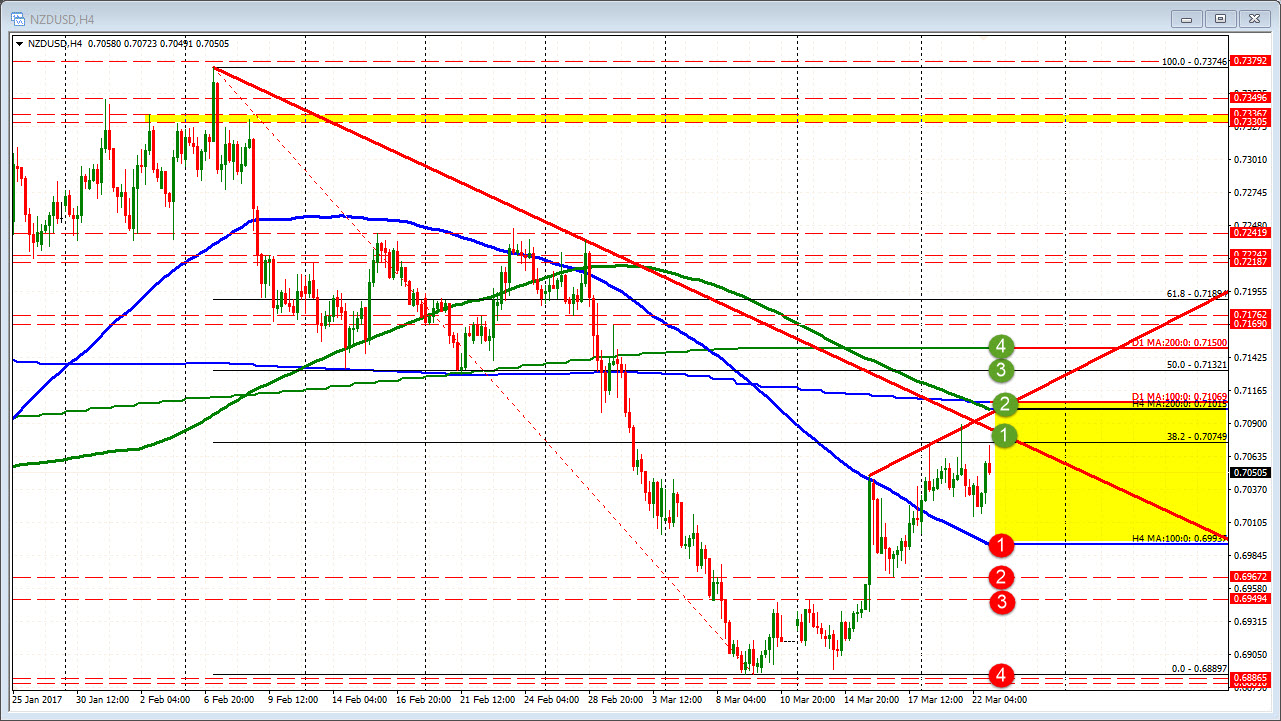

The RBNZ kept rates unchanged as expected. The NZUSD remains confined between support below near 0.7000 and resistance above near 0.71000 (see chart below). A move out of the yellow area will be eyed by traders going forward.

Below is snapshot of the winners and losers in trading today.