Forex news for New York trading on October 21, 2016

- Canadian trade minister calls an end to EU trade talks

- Canada August retail sales -0.1% vs +0.3% expected

- September 2016 Canadian CPI 1.3% vs 1.5% exp y/y

- CFTC Commitments of Traders: Dollar longs hit highest since January

- Fed's Williams: Makes sense to hike sooner rather than later

- US Baker Hughes total rig count 553 vs 539 last week

- NY Fed 4Q GDP estimate drops to 1.4% from 1.6% previously. 3Q down to 2.2% (from 2.3%)

- European Commission still hopeful Canadian trade deal not dead

- ECB's Nowotny: Expect Eurozone inflation of 0.2% for 2016, over 1% for 2017

- Lehman Brothers situation will not be repeated says ECB's Nowotony

- October 2016 Eurozone consumer confidence flash --8.0 vs -8.0

- Belgian business confidence -1.8 vs -1.5 expected

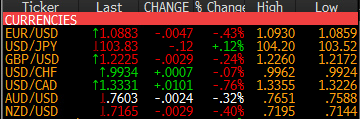

Markets:

- S&P 500 flat at 2141

- US 10-year yields down 2 bps to 1.73%

- WTI crude up 27-cents to $50.90

- Gold up $1 to $1266

- JPY leads, CAD lags

Weak retail sales and low inflation numbers cut the knees out of the Canadian dollar. It was already wobbling after yesterday's hint about a rate cut and even a recovery in oil prices couldn't help the loonie off the canvas. USD/CAD immediately jumped to 1.3325 from 1.3233 on the data. That knocked out some big resistance levels in a jump to the best levels since March.

EUR/USD trading was to the downside once again. The pair made a move higher at yesterday's ECB but has been sagging since and it took out the June low early in New York as stops busted down to 1.0870. The low of the day later was 1.0859 until some late-day profit taking on a crowded short finally gave it a lift to 1.0880. Imagine someone was thinking of leaving the Eurozone?

Cable bottomed at 1.2172 early in North American trading and eventually recovered all the decline from Europe in a climb to 1.2230. That helped the pair back into modestly positive territory on the week.

AUD/USD fell hard Thursday and slow selling continue Friday. Most of the damage was done early as the pair sank down to 0.7590 from 0.7630. We finished close to the lows but still only down slightly on the week.

Have a great weekend.