Forex news for New York trade on January 20, 2017:

- Donald Trump takes the oath of office. Becomes 45th President. Highlights of his speech

- Trump White House policy pages updated: US will withdraw from TPP, nothing on China manipulation

- November 2016 Canadian retail sales 0.2% vs 0.5% exp m/m

- Canada December CPI 1.5% y/y vs 1.7% expected

- Fed's Williams: Not worried about student loan bubble

- New York Fed Nowcast sees Q1 at 2.7% vs 2.1% last week

- Baker Hughes US oil rig count 551 vs 522 prior

- Bank of Italy forecasts growth at 0.9% in 2017

- Fed's Harker: May have to reassess rate path if there's a big fiscal stimulus

- Harker: Inflation on course to meet 2% target this year or next

- BOJ's Kuroda: Forex move tough to predict, affected by various factors

Markets:

- Gold up $3 to $1208

- WTI crude up $1.05 to $52.42

- US 10-year yields flat at 2.47%

- S&P 500 up 7.6 points to 2271

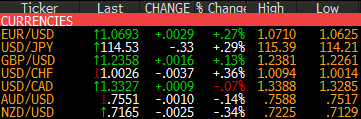

- Swiss franc leads, New Zealand dollar lags

There's a new man in the White House. Donald Trump took the oath of office and delivered a campaign-style speech where he attacked the Washington establishment. The US dollar wobbled lower but quickly recovered. He didn't single out any person or country and that was one of the tail risks coming in.

USD/JPY chopped around 115.00 for most of the day with some large options running off at the figure but late in the day, protests in Washington and sliding Treasury yields pulled down the pair. Stops below 114.50 led to a quick move down to 114.20.

At the same time, the US dollar came under broad pressure, leading to session highs in EUR/USD and cable. The pound was the top performer on the week and reversed earlier losses today to finish modestly higher.

USD/CAD rose early in the day on soft Canadian economic data. The pair hit a two week high of 1.3388 but the gains were capped by a rally in oil prices. Crude was up 2% and hardly dented by a massive increase in drilling rigs in the Baker Hughes report. The pair finishes the week near 1.3326.

The Australian dollar finished strong after a dip in Asia. AUD/USD chopped in the 0.7535 range for most of US trading until a late bid pushed it to 0.7564. That was 20 pips from the Asian high and prevented a loss on the day.