Forex headlines for New York trade on June 19, 2017:

- Fed's Dudley: Wages and inflation should pickup, pleased with economy

- White House weighs new position for Sean Spicer, no final decision - report

- Britain and EU agree to provisional dates for Brexit talks

- BOE's Forbes says the central bank is underestimating inflation

- Merkel wants to do joint corporate tax reform with France

- Wilbur Ross: Neither Canada nor Mexico are currency manipulators

- MPC's Forbes replaced by LSE professor Tenreyro

- IMF's Lipton says it's premature for BOJ to talk about policy normalization

Markets:

- Gold down $9 to $1244

- WTI crude down 63-cents to $44.11

- S&P 500 up 20 points to record 2453

- US 10-year yields up 3.6 bps to 2.19%

- USD leads, JPY lags

Coming into the day, the market still wasn't quite sure that Yellen was serious last week. She was optimistic and hawkish but Kaplan was cautionary on Friday and the market has been taken off balance by soft US economic data.

On Monday, Dudley used even more optimistic and hawkish language than Yellen. He expressed an abundance of confidence in the economy and inflation. The market was slow to digest them but it set off a steady stream of US dollar buying that continued throughout the day.

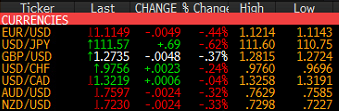

EUR/USD started near the 1.1214 session high but Dudley sent it down to 1.1175 and it slowly drifted to 1.1149 from there as it erased Friday's gain.

USD/JPY climbed to 111.25 from 111.00 initially and stalled ahead of Friday's high of 111.44. Selling in Treasuries led to a continued bid and the pair finished near the 111.57.

Stocks helped to underpin the dollar as the S&P 500 busted above the June highs to a new record. Tech led the way once again.

Cable rose above 1.2800 in Europe but sagged as New York arrived and continued the fall all the way to 1.2720 before a 15 pip bounce late. It's the fourth day in a row that a rise above 1.2775 has failed to hold.

USD/CAD finished flat, which is a good performance for the Canadian dollar despite the drop in oil and broadly stronger USD. That suggests that many of those in crowded long USD/CAD positions are squaring up.

AUD and NZD finished down a quarter cent in a slow drift lower.