Forex news for US trading on Feb 19, 2016

- UK source: UK/EU Draft agreement has makings of a deal

- US major indices end the day mixed

- Lithuanian President: EU deal reached with the UK

- The key events and release for the week starting February 22

- CFTC commitment of traders report: EUR shorts trimmed by 15K in the current week

- The WTI Crude settlement at -3.7% at $29.64

- Baker Hughes rig counts down again. Total rigs down to 514 from 541

- European stocks manage a winning week

- Fed's Mester comments to reporters: CPI consistent with gradual rise in inflation

- February 2016 Eurozone consumer confidence -8.80 vs -6.70 exp

- Constancio highlights the hail Mary pass central banks are undertaking

- Q&A Mester: Fed policy is going to moving gradually higher

- ECB will do what it has to for price stability says Visco

- No one knows how far is too far for negative rates says Constancio

- Constancio: If ECB eases further we'll have to consider effects on banks

- Markets are signalling a lack of trust in growth and inflation says Constancio

- US Feds Mester: US economic fundamentals remain sound

- ECB's Constancio: Inflation would have been negative if not for ECB

- January 2016 Canadian CPI 2.0% vs 1.7% exp y/y

- January 2016 US CPI 1.4% vs 1.3% exp y/y

- Canada retail sales for December -2.2% vs. exp. -0.9%

- Button on the Loonie - Our man in Canada is predicting rainy days

The week has drawn to an end with a fairly benign Friday NY trading session. There was some late day movement in the dollar and in particular the GBP as tweets about the UK/EU drama being over hit the newswires (from the Lithuanian president) The market traders seemed to have figured something was going to happen earlier however, as the GBPUSD squeezed higher around the time London traders exited for the weekend. The GBPUSD has tacked on another 14 pips above the day's highs on the late NY afternoon headlines/speculation. Of course there is details and then a referendum later this year.

The EURUSD ended it's 5 day losing streak today, rising for the first time since February 11. The modest up day did not occur until the squeaking out a new low for the week at 1.1066 (vs 1.1070). Down near the lows was the 200 day MA at 1.1053. With the pair trading at 1.1126 we are still not that far from that key MA level. So be aware of the level for next weeks trade.

The USDJPY ended lower on the day but it is what it could not do this week that has me interested. What it could not do is get above and stay above the 200 hour MA. It peaked above on Wednesday and Thursday, but each look failed. The 200 hour MA is at 113. 61 currently (and moving lower).

The USDCAD was a big disappointment for the bulls. The retail sales were bad and oil prices fell as well - fundamentals that should lead to huge move higher. Well the price did go higher but ran into resistance against the 200 hour MA and rotated back lower. The pair is ending the week below the 200 hour MA at the 1.3831 and the 100 hour MA at the 1.37719. The AUDUSD and the NZDUSD has similar reversals in their NY afternoon sessions.

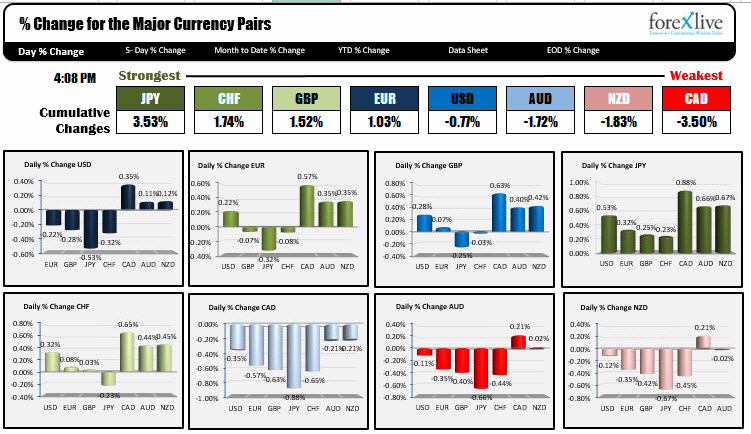

Below is how the major currencies did again each other today.

For the greenback, the dollar lost ground against the EUR, GBP, JPY and the CHF, but squeaked out gains against the commodity currencies.

Next week it is a fairly quiet week with Durable goods coming out on Thursday in the US along with the 2nd cut of GDP for the 4Q (does it matter?). The US home sale data will be released and some data on confidence (conference board and Michigan consumer sentiment).

Wishing all a great weekend.