Forex news for US trading on April 18, 2017:

- UK election is a game changer for the pound says Deutsche Bank

- The first UK election poll is out

- Why Goldman Sachs has given up on the dollar

- March 2017 US housing starts 1.215m vs 1.250m exp

- New Zealand dairy auction GDT price index 3.1%

- US considering shooting down North Korean missile tests

- ECB bought €12.482bn vs €16.681bn in latest weekly QE count

- March US industrial production +0.5% vs +0.4% expected

- IMF bumps 2017 global growth outlook

- Fed's George says US economy is on solid footing

- Canada March existing home sales +1.1% vs +5.2% prior

- BOC's Wilkens: Canada should embrace new technologies while managing side effects

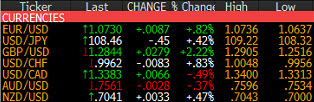

Markets:

- Cable climbs 2.2% to touch a six-month high

- S&P 500 down 7 points to 2342

- Gold flat at $1289

- WTI crude down 30-cents to $52.35

- GBP leads, CAD lags

It was all about the pound today after Theresa May called a snap, surprise election. The pound sold off at first as the rumours spread but had a quick re-think and bought GBP. No doubt, part of that was because shorts were so crowded. But also factor in that it will give May a stronger hand and a more stable mandate. There's also talk that she could reposition the UK for a softer Brexit.

In any case, it was a very strong, steady climb from 1.2520 to 1.2900. The grand finale came in the US afternoon when stops busted above 1.2800 in a flash move to 1.2905. The pair finished at 1.2840.

Meanwhile, the Treasury market was cruising higher as the reflation trade comes undone. That weighed on USD/JPY in a slide to 108.40 from 108.75. Watch for a breakdown in that pair if 108.00 and 107.85 give way.

The euro was along for the ride with the pound as it climbed to 1.0730 from 1.0650. That's the highest since March 29.

USD/CAD continued the push-and-pull as it touched 1.3400 from 1.3325, in part due to housing worries and signs the government will meddle. The slide in oil also hurt.