Forex trading news for January 17, 2017.

- US stocks end lower. Can't get in the black.

- A day closer to the inauguration. USDMXN stalls at 38.2% retracement

- US crude oil futures close at $52.48/barrel

- Deutsche bank to pay 7.2B in Residential Mortgage Back Securities to DOJ

- 12 key points of May's Brexit plan; Implications for GBP outlook - BTMU

- Forex trading video: A look at the EURUSD as it tests the retracement target and stalls

- The market is excited about May's vote pledge but it's not all it seems

- USD/JPY sinks to session low in seventh day of declines

- FTSE suffers despite a strong Brexit message from May

- The EU is ready to negotiate as soon as the UK is ready

- The US economy has made really nice progress says Fed's Brainard

- A prosperous Europe is in the US's economic interest says Jack Lew

- Fed's Brainard: Risks to domestic economy close to balance

- 5 key points from May’s speech and what they mean for Brexit and the pound

- EU's Tusk throws May a bone

- Fed's Dudley Q&A: I think 2% inflation is very likely in the next couple years

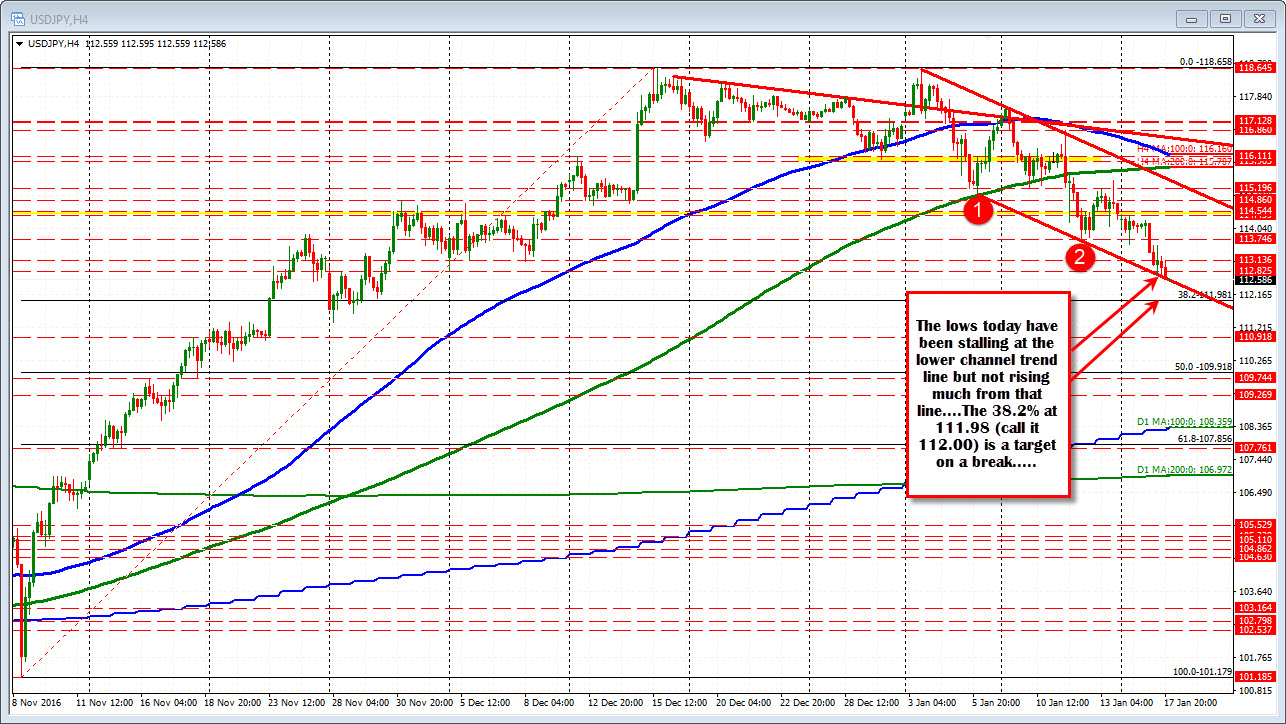

- Forex technical analysis: USDJPY tests lower channel trend line

- Brexit's Davis: If parliament rejects Brexit deal it won't change the fact the UK is leaving

- New Zealand dairy GDT price auction 0.6% vs -3.9% prior

- Fed's Dudley: Dollar's recent gains will put downward pressure on prices

- January 2016 Us Empire State manufacturing 6.5 vs 8.5 exp

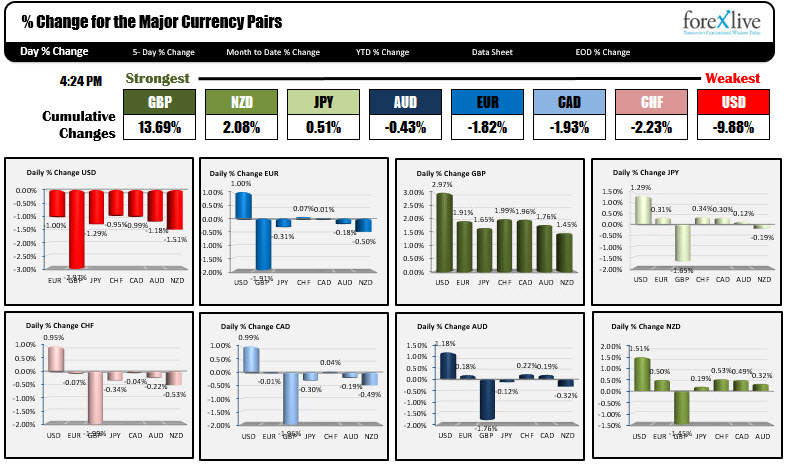

- The strongest and weakest currencies as NA traders enter for the day

In other markets:

- US stocks lower with S&P down -0.30%. Nasdaq down -0.63%. Dow down -0.30%

- US yields are lower with 10 year down of 7 bp and 30 year down near 6 bp

- Spot Gold is the beneficiary of a lower dollar as it rises $13 to 1215.93

- WTI crude after hours are trading at $52.51, up +$0.14 or +0.27%

Today, it was about the GBP surging higher and the USD moving lower. Those two currency pairs were the focus. The pairs saw relatively modest moves against each other.

The GBP focus was on the speech by PM May. She did not back down from having a full break from the EU single market, and outlined a 12-point plan for the "hard exit" , but said that Britain will seek the "greatest possible access to it through a new comprehensive, bold and ambitious free trade agreement". She also said that Parliament would have a vote on the final terms of the exit. The news was worth a a surge of about 2.9% vs the USD. That was the largest one day gain since 1998.

In terms of price the GBPUSD pair had a low 1.2015, while reaching a high of 1.2414 (1 pip shy of 400 pips on the day). In the process, the pair has spiked above the 100 hour MA, 200 hour MA, 100 bar MA on the 4 hour chart, 38.2% retracement of the move down from the December high, 50% at 1.2380 (*key level now), and lastly, the 200 bar MA on the 4-hour chart at 1.2398. The final hurdle has been broken in NY afternoon trading.

We are not running away from that final level - the market is a bit out of breathe after 400 pips - but it is not really backing off either. As mentioned the high for the day extended to 1.2414.

Keep in mind that although there is the whole process of Brexit which has to be played out, and the uncertainty can keep the currency on edge (a risk lower), inflation today was reported higher than expectations (higher import costs from the falling GBP?). Also, in the month of December, the GBPUSD reached as high as 1.2774. We are still only around the 1.2400 level. As noted, the 50% of the move down from that peak comes in at 1.2380. A move below that 50% midpoint level would need to be seen to take some of today's bullishness away. PS the GBPUSD high for January is at 1.2431 which is the next target. The 61.8% comes in at 1.2473 and the 100 day MA is up at 1.2577.

The move higher in the GBPUSD has been helped by a sharp fall in the EURGBP, That cross currency pair moved 190 pips today. In the process, it fell and looks to close below the 100 day MA at 0.86377 Last Monday, the price moved above that MA line as the fears of Brexit started to materialize. The "after the fact" tumble today, takes the pair back below that key MA line.

The USDJPY is ending the NY session at the lows and also testing a lower channel trend line on the 4-hour chart. Like the other pairs, the range for the day was extended at 172 pips. This pair is down over 600 pips since the early January high. That is a lot in a relatively short period of time, but remember, from election day ot the highs in mid- December and early January, that pair moved up nearly 1750 pips. The 38.2% of that move comes in at 111.98 (call it 112.00). On a break of the trend line, that level should be tested.

The AUDUSD moved sharply higher in the Asian session and just grinded higher for the rest of the London and NY session. Technically, the pair started the move higher by holding support just above the 100 hour MA (at 0.7461. The low reached 0.7464). Later, a break above the 100 day MA (at 0.7505)) ignited another surge higher.

The USDCAD closed the day's session near the 50% of the move up from the May low at the 1.3029 level. The low did print below that 50% retracement level (the low reached 1.30176), but it was only for a single 5-minute bar. The failure to extend lower, did lead to more up and down trading for the rest of the trading day (the corrective high did extend to 1.3077), but at the close the pair was back down to 1.3040 - just 11 pips away from the key retracement level. Will it hold in the new trading day or will we see a continuation of the dollar selling trend through that level?

Below is the snapshot of the % changes of the major currency pairs.