Forex news for traders on April 17, 2017.

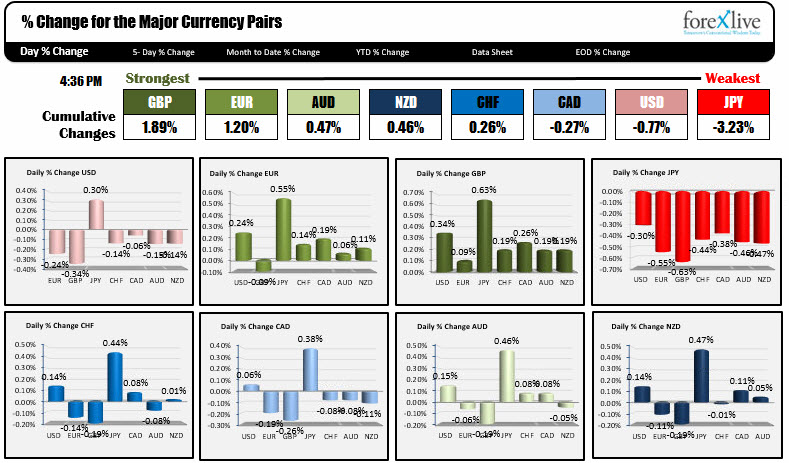

- A end of day snapshot of the strongest and weakest currencies for the day

- US Treasury secretary Mnuchin in the FT - comments on the USD

- US stocks end the session at the highs

- Treasury Secretary Mnuchin helping to give the dollar/stocks a lift

- US crude oil futures settle at $52.65/BBL

- VP Pence Update: Expected to agree on framework for further economic talks with Japan

- Erdogan talking about referendums on everything and about more war

- Major earning releases this week.

- See the new French election poll, it's similar to the old French election poll

- What's on the US economic calendar this week

- NAHB Housing Market index 68 vs 70 est

- Fed's Bullard: I could probably be persuaded to make one move or so

- Trump expected to nominate Randal Quarles as Vice-Chairman of supervision at Fed

- April Empire Fed manufacturing index +5.2 vs +15.0 expected

- The strongest and weakest currencies as NA traders enter for the day

In other markets:

- Spot gold $1284.50, down -$1.24

- WTI crude oil $52.75, down -$0.40

- S&P index up 0.86%. Nasdaq up 0.89%. Dow up 0.90%.

- 2 year yield 1.19%, unch. 5-year 1.773%, unch. 10-year 2.246%, +0.8 bp. 30-year 2.904%, +1.2 bp

It was Easter Monday in Europe today. So activity had the potential to be choppy in the currency markets today. Empire Manufacturing came out weaker than expected at 5.2 vs 15.0 estimate. That helped to give the dollar some weakness. However, the JPY pairs did not follow the dollar lower. In fact early on, the USDJPY moved higher and that also dragged the JPY crosses higher. It seemed that the flows were involving JPY and with low liquidity, that can drive a market.

Later in the NY afternoon session there was comments from Treasury Secretary Mnuchin that a tax cut was in the cards for 2017. That helped push stocks to highs (they closed up 0.86% to 0.90% and at the highs). US bond yields moved into the black as well. The 10 year traded as low as 2.196% earlier in the day, but closed near 2.25%. Good comeback. Higher stocks and higher bond yields has been a recipe for higher USDJPY and that dragged up the JPY crosses as well. The all closed near their highs for the day.

In other fundamental news today, the NAHB Housing Market index was lower at 68 vs 70 estimate but it remains near the highs going back to 2000. No real impact from that data.

How did the technicals play a role in trading today?

EURUSD. As the EURUSD was moving higher in the NY morning session, the price moved up to within a pip of a target at the 200 bar MA on the 4-hour chart. Sellers leaned against the level (1.06708 was the MA, the price reached 1.0670) and the EURUSD price backed off. Remember that MA level going forward. The fall took the price back down to 1.0634. In the new day, the 100 day MA, the 100 hour MA, the 200 hour MA all come in at 1.06236 - 1.06257. IF the 200 bar MA on the 4-hour chart is strong resistance, the 1.0623-25 is strong support.

USDJPY. The USDJPY fell below the 200 day MA on Friday and apart from a quick look above in the early Asian session today, the price stayed below that key MA into the NY session. However, as mentioned buyers were around for most of the NY session and by the close, the price technically had moved back above the 200 day MA at 108.76. That's more bullish on the failed break. The pair spent the last few hours trading above and below the 109.00 level. The 100 hour MA is also at that area (at 108.991). In the new day, I would expect to see buyers on dips toward the 200 day MA (close risk level for longs). Let's face it, the sellers had there shot to unravel the pair on the break below the 200 day MA. They failed. So what was resistance, now becomes support. Stay above is more bullish.

GBPUSD. The big highlight for the GBPUSD today is it closed at the highest level since February 1st. The prior high close has been 1.2556. We eked out a close at 1.2561 today. Yippee! The not so exciting thing about the price action is the high extended up toward 1.2600 (high reached 1.25956) but could not go any further. The ok technical is that the low stalled at 1.2555. Are traders paying attention to the highest close since Feb 1? It's a stretch but that WAS the highest close. So if you want to lean against it, maybe there is something about it - for a trade at least.

Below is a snapshot of the % changes of the major currencies vs each other. The GBP is the strongest today while the JPY is the weakest.