Forex news for US trading on February 16, 2017:

- February 2017 US Philly Fed business outlook index 43.3 vs 18.0 exp

- US initial jobless claims 239K vs 245K est.

- US January housing starts 1246K vs 1226K expected

- Trump: Tax reform will happen pretty quickly

- Trump: "I inherited a mess"

- Treasury sells 30-year TIPS at 0.923% vs 0.875% WI

- Iraq southern oil exports continue to slip

- Alexander Acosta will be Trump's new labor secretary nominee

- Fed's Lockhart: Progress towards inflation goal happening sooner than thought

- It could be chaos if there's no Brexit deal reached in 2 years says ECB's Nowotny

- EU official says a deal with Greece is possible in March

Markets:

- Gold up $6 to $1239

- WTI crude up $0.31 to $53.42

- S&P 500 down 2.5 points to 2346

- US 10-year yields down 4 bps to 2.42%

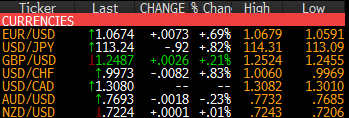

- CHF leads, AUD lags

The early story was yet-another round of strong US economic data. The Philly Fed soared higher but the US dollar couldn't get any traction. I talk about why here.

Later Trump called a surprise press conference and that kept markets on edge for 90 minutes. In the end, Trump's unusual (or usual for him?) performance didn't matter to markets. He hardly spoke about the economy or taxes and what had been a 7 point loss in the stock market recovered to a 2 point loss at day's end.

Otherwise, the theme was USD weakness. The euro completed a three-day reversal pattern in a rally to 1.0679 with the peak coming at the London fix. It dipped 30 pips from there only to rebound and finish close to the highs.

USD/JPY chopped lower through Asian, European and US trading in steps, finally falling to 113.10 late. The latest dip didn't set off any fresh stops with bids at 113.00 holding. The selling might have been mitigated by a terrible TIPS auction.

USD/CAD was bounced around by oil. Crude hit an 80-cent air pocket only to flatten out for a few hours and then jump right back to $53.43, finishing 30 cents higher on the day. That still wasn't good enough for USD/CAD as it recovered all its European losses to finish flat at 1.3075. The rest of the commodity bloc also finished flat.