Forex news for US trading on February 14, 2017

- Fed's Yellen: Hike appropriate at one of its upcoming meetings

- Yellen: Wage growth has picked up but it's not dramatic

- Yellen: There may be significant policy changes that affect the outlook

- Fed's Lockhart: I don't see a compelling reason for March hike

- Lockhart: US economy well-poised for growth and moderate rate hikes

- Fed's Kaplan: US consumer has been strong

- Kaplan: Would be wise to ease up on monetary policy gas pedal

- Fed's Lacker: US rates need to rise quicker than expected

- Fed's Lacker: Risks of bad inflation outcome aren't gigantic

- The IMF's involvement remains essential for the Greek program to continue

- January Teranet Canada house price index +13.0% y/y vs +12.3% prior

- January 2017 US PPI final demand 0.6% vs 0.3% exp m/m

Markets

- Gold up $2.50 to $1227

- S&P 500 up 9 points to record 2336

- US 10-year yields up 3.6 bps to 2.47%

- WTI crude up 28-cents to $53.20

- AUD leads, GBP lags

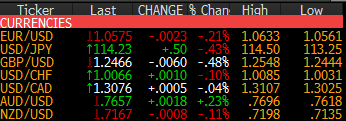

Yellen delivered on the volatility front. She was constructive on rate hikes this year without giving anything away on the timing. That was more than enough to send the US dollar 75-100 pips higher across the board.

USD/JPY was chopping in a tight range near 113.40 before the testimony hit at 10 am ET. The move wasn't a straight line but over an hour the pair rose a full cent. It finally ran into offers right at 114.50, which was the high of the day. It's scaled back 25 pips late.

EUR/USD has struggled to break below 1.06 lately but took it out on the Yellen headlines and sank to 1.0561. Watch the close here. The Jan 16 low was 1.0580 with the pair trading just below at the moment. Either way, losses in six of the past seven days are a negative sign.

Cable held its own in the USD rally on Yellen but was hit hard by inflation numbers early and that sent it down to 1.2450. It chopped in a 30 pip range above there for the US session.

The commodity currencies showed some resilience to the US rally. AUD/USD was initially knocked down to 0.7620 from 0.7680 but has slowly clawed its way back to 0.7655. That's higher on the day.

Similarly, USD/CAD and NZD/USD finished the day flat despite some quick falls on the Yellen headlines.