Forex news for trading on May 12, 2017.

- US stocks end mixed. Nasdaq squeaks out a gain. Closes near highs.

- CFTC Commitments of Traders: EUR net speculative positions long for the 1st time since May 2014

- Key economic releases/events next week

- Crude oil futures settle at $47.84 /BBL

- USD/CHF was the top performer this week

- Fed's Harker: Would prefer to begin shrinking balance sheet after two hikes

- Japan's Aso said he told G7 about problems of China's excessive credit

- Harker Q&A: We're starting to see some wages pressures building

- Baker Hughes US oil rig count 712 vs 703 prior

- Fed's Harker: Still sees two more hikes this year

- Ray Dalio: The near term looks good but the longer term is scary

- AUDUSD will shortly be on its way to 0.7160 says Morgan Stanley

- A fine finish to the week for European stocks

- Brexit will be negative and significant for Ireland says IMF

- Atlanta Fed Q2 GDPNow forecast 3.6% vs 3.6% prior. Goldman and NY Fed see better growth

- G7 finance ministers warn of risks to emerging markets from US dollar

- Fed's Evans: I could be ok with one hike if the inflation outlook is uncertain

- Who would launch a cyber attack on hospitals?

- Latest Philly Fed economic survey raises Q2 GDP, lowers core CPI forecasts

- March US business inventories +0.2% vs +0.1% expected

- May U Mich prelim consumer sentiment 97.7 vs 97.0 expected

- Fed's Evans: You would expect if there was no jobs slack, wages would go up

- In a further sign that June Fed hike hopes are collapsing...

- ECB to signal a policy shift mid-year - report

- Fed's Evans: Inflation pressures are still underrunning our 2% target

- The odds of a Fed hike after retail sales and CPI

- Dollar hit by weak data on a Friday? Sounds familiar

- US data disappoints but it doesn't herald the end of a June hike

- April US consumer price index +2.2% vs +2.3% y/y expected

- April 2017 US advance retail sales 0.4% vs 0.6% exp m/m

In other markets today:

- Spot gold is trading up $3.25 to $1228.34

- WTI Crude oil is trading at $47.86, up $0.02.

- S&P index -0.15%. Nasdaq up +0.09%, Dow down -0.11%

- 2 year yield 1.288%, -4.6 bp. 5 year 1.845%, -6.9 bp. 10 year 2.324%, -6.3 bp. 30 year 2.986%. -3.8 bp

The US Retail sales for April came in at 0.4% (est 0.6%) vs 0.1% in March (revised higher from -0.2%). The Ex Auto and Gas and control group figures were also weaker than expectations at +0.3% (vs +0.4%) and +0.2% (vs +0.4% est). Although weaker than expectations, they were step in the positive direction.

CPI headline and ex food and energy yoy came in lower than expectations at 2.2% and 1.9% repectively (2.3% and 2.0% was the expectations). The MoM number were about as expected.

The Real average weekly and hourly earnings from a year ago were higher - by +0.3% and +0.4% respectively. However, the increases are certainly not out of control by any stretch of the imagination.

The news sent the dollar a little lower in early NY trading.

Later there was a report from Germany's Der Spiegel saying that the ECB will start to withdraw the "super expansionary policy" in the fall by starting to taper the 60B of QE bond purchases. That helped to strengthen the EURUSD (and weaken the USD a little further).

In other news today, the preliminary Michigan sentiment index rose to 97.7 from 97.00 (soft data though). The US Business inventories rose by 0.2% vs 0.1% estimate.

The latest GDP guesstimates were out today with the Atlanta Fed staying unchanged at 3.6% for the 2Q. Goldman Sachs moved to 3.1% from 2.9% and the NY Fed also moved higher but only to 1.9% from 1.8%. The expectations of a hike came down a touch depending what tool you look at, but the market is still expecting the Fed to continue to to tighten.

Taking a look at some of the major currency pairs.

The GBPUSD stayed below the 1.2900 level in trading today and traded at the lowest level since May 4th (low reached 1.28413), but in the NY session the low could only get to a key support level at 1.2860. So the pair remains in stuck between support at 1.2860 and resistance at 1.2900. Looking for a break one way or the other on Monday.

The USDJPY fell toward trend line support at the 113.18 level and found buyers. Other support levels against the 200 hour MA and the 100 day MA at 112.997 remain as key technical support targets in the new week. Get below and there should be more selling. Stay above and we will see the USDJPY move back toward the 100 hour MA at 113.782.

As mentioned, the EURUSD got a little extra push as a result of the Der Spiegel report. That helped to push the pair above the 200 hour MA at 1.0914 and although that MA line was tested twice on the hourly chart, it also held support twice. Into next week's trading that MA will be a key barometer for bullish and bearish. On the topside, the 50% of the move down from the Monday high at 1.0930 was broken but not by much. Get above on Monday, and the buyers will feel more bullish.

The USDCHF fell sharply around the time London traders were exiting. Technically, the pair fell below the 100 hour MA at the 1.0050 area. The selling did not stop until the parity level was broken and the pair got close to the 200 hour MA and 50% retracement at 0.9977-80 area (the low reached 0.9987). We are closing the week around the natural 1.0000 level. Above or below that level might be the bullish (above) bias or the bearish (below) bias in the new trading week.

For the week, the USDCAD chopped up and down in a 128 pip trading range (between 1.3640 and 1.3770). The pair is closing the week near the 200 and 100 day MAs -between those two high/low extremes - at 1.37099 and 1.3702 respectively. Oil prices were an impact with prices moving higher this week. Technically, the market will initially look for the move away from the MA levels as the bullish or bearish bias. If the extreme (in the direction of the break) can be broken, there should be more momentum in that direction.

Wishing you all a great weekend with family and friends. Happy Mothers Day to my Mom and all the mother out there....

-----------------------------------------------------------------------------------------------

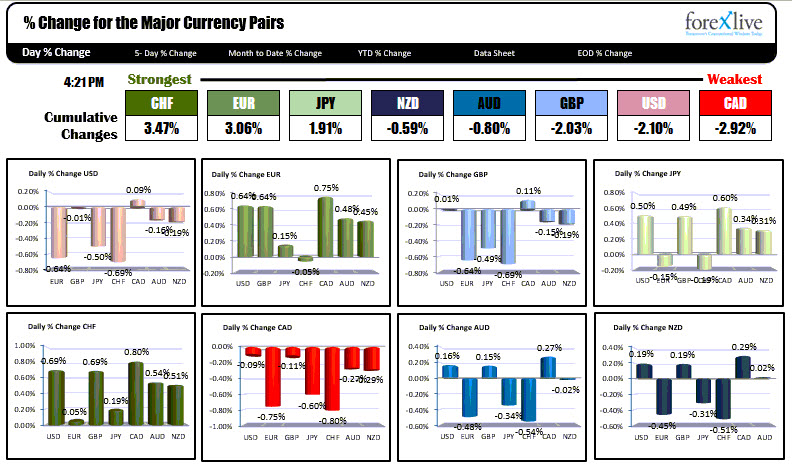

Below is a snapshot of the winners and losers for the trading day. The CHF and the EUR were the strongest, while the CAD and the USD were the weakest.