Forex news for NY trading on January 11, 2017

- S&P and Nasdaq close near highs. Nasdaq close is a record.

- What's next for the Canadian dollar

- EURUSD works its way back to support as momentum slows

- WTI Crude futures settle at $52.25 / barrel

- Trump takes biotech to the woodshed

- Gold closes in on $1200 in flight to safety

- ...and that's why we watch bond auctions. USD/JPY falls to four-week low as yields drop after strong auction

- Huge bid in appears at US 10-year auction

- That was the best US TV since JR got shot

- Mexico is "nice" says Trump

- Is that it from Trump? USD is getting smoked

- Trump: Maybe intelligence agencies released the Russian report

- Trump speech kicks off with spokesman dismissing Russia and other stories

- Dollar moves higher ahead of Trump

- US EIA crude oil inventories 4097k vs 1500k exp

- Carney: Some recent data aligns with the BOE's upgraded forecasts

- December 2016 UK NIESR Q4 GDP estimate 0.5% vs 0.5% exp q/q

- Everything is political fair game in the future

- Carney: Brexit is not the biggest risk facing the UK

- Our responsibility is to identify risks says Carney

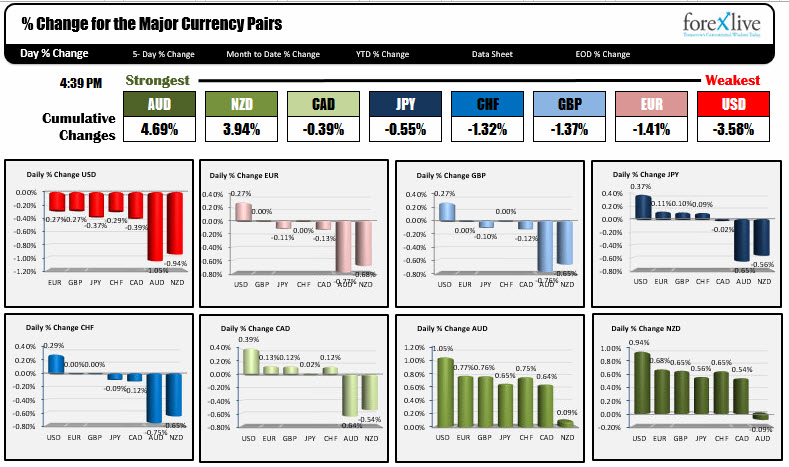

- The strongest and weakest currencies as NA traders enter for the day

- US MBA mortgage data improves w-e 6 Jan

In other markets at the end of the day:

- US stocks close higher: S&P index +0.28%. NASDAQ composite index +0.21%. Dow Jones industrial average +0.5%

- US debt market: 2-year note 1.18% unchanged. 5-year note 1.884%, +1 basis point. 10 year note 2.372%,, unchanged. 30-year bond 2.95, -1.2 basis points

- Spot gold $1191, +4 dollars or +0.34%

- WTI crude oil futures after market $52.37, plus $1.55 or +3.05%

- European stocks ended mostly higher: Germany's DAX +0.54%. France's CAC +0.01%. UK's FTSE +0.21%. Spain's Ibex -0.46%. Italy's FTSE MIB +0.32%

He walked into the room late and stood on the side. A speaker spoke about how corrupt the press was - to the press - and then introduced the Vice President. He introduced the President-elect and there was some applause (I assume from staffers. I have never heard applause at a press conference, nor an introduction. They normally just walk in). It felt like a campaign rally. That was just the beginning. In his opening remarks he blasted the pharma industry (down goes the stock market). He could not help but talk about Hillary. He DID not talk about infrastructure spending or repealing regulation. His legal counsel talked about what the President elect would do with his businesses and investments. There was talk of Russia and Putin. He also had a shouting match with a CNN reporter who pleaded to ask a question. Trump pointed at him and said "You are fake news" and flatly refused. The King was in his court and he was in charge. The presser was like no other.

What did the markets do?

Coming into the presser, the dollar was bid. The EURUSD had moved below the 1.0462 level - the low price from 2015. The GBPUSD had moved below the lowest low (below 1.2082), since the October flash crash. The USDJPY was breaking above the 200 hour MA at 116.62.

After Trump started, the dollar reversed and went lower. Bond yields went lower (on no infrastructure) and so did stocks (on pharma comment and no infrastructure).

Soon after he was done, the US auctioned off 20bln 10 year bonds. The demand was great and that sent the dollar even lower still.

However, as the NY afternoon rolled on, the stock market started to rebound, the bond yields moved back toward unchanged, and the dollar started to wander back higher. Nevertheless, the dollar still maintained its status as the weakest currency of the day. All the major currencies rose against the greenback.

So what is the trading status for some of the major pairs?

The EURUSD moved to a low price of 1.04533 before the presser. That was below the 1.0462 swing low from 2015. Although the level was broken, the momentum slowed. As the presser progressed the EURUSD started to rally. Technical levels including the 200 hour MA (at 1.0520) and the 100 hour MA (at 1.0561) were broken. The high price stall in the area of the swing highs from Jan 5th, 6th and again yesterday at 1.0621 area. The wander back lower stalled ahead of the 100 hour MA at 1.0561. That level is key in the new trading day. So far, support is holding.

On Tuesday, the USDJPY fell below the 200 bar MA on the 4-hour chart (currently at 115.63). Each break saw the price move below by about 20 pips, but quick rebounds. Today, that MA was broken and the price tumbled 138 pips, before moving all the way back up 136 pips. That recovery rally stalled just below the MA at 115.63. We trade at 115.35 into the new trading day. If the price stays below 115.63, the sellers are still in control. A move above and the waters get more muddy -and more bullish.